- India

- /

- Real Estate

- /

- NSEI:AMJLAND

Does AMJ Land Holdings (NSE:AMJLAND) Deserve A Spot On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like AMJ Land Holdings (NSE:AMJLAND). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for AMJ Land Holdings

How Fast Is AMJ Land Holdings Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. As a tree reaches steadily for the sky, AMJ Land Holdings's EPS has grown 35% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of AMJ Land Holdings's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. To cut to the chase AMJ Land Holdings's EBIT margins dropped last year, and so did its revenue. That is, not a hint of euphemism here, suboptimal.

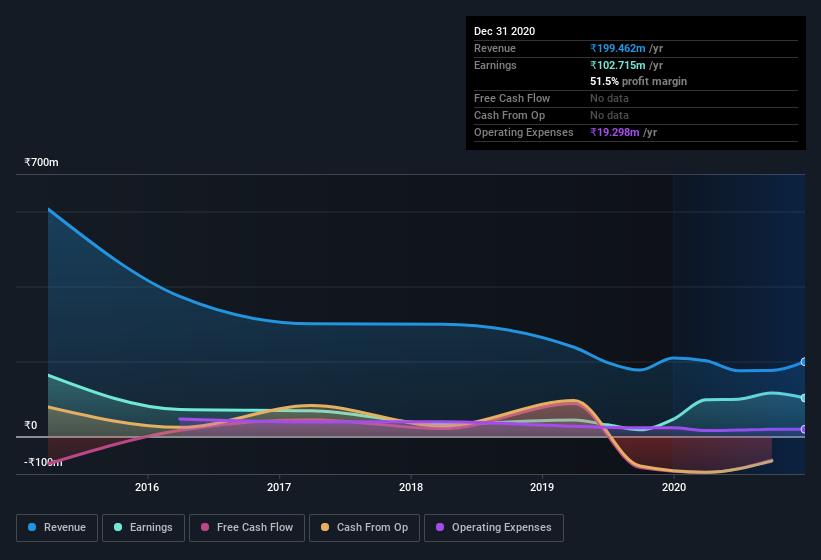

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

AMJ Land Holdings isn't a huge company, given its market capitalization of ₹955m. That makes it extra important to check on its balance sheet strength.

Are AMJ Land Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling AMJ Land Holdings shares, in the last year. With that in mind, it's heartening that Arunkumar Mahabir Jatia, the Non-Executive Chairman of the company, paid ₹499k for shares at around ₹24.95 each.

Does AMJ Land Holdings Deserve A Spot On Your Watchlist?

You can't deny that AMJ Land Holdings has grown its earnings per share at a very impressive rate. That's attractive. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. So on this analysis I believe AMJ Land Holdings is probably worth spending some time on. Even so, be aware that AMJ Land Holdings is showing 4 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of AMJ Land Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading AMJ Land Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:AMJLAND

AMJ Land Holdings

Through its subsidiary, develops and leases real estate properties in India.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives