- India

- /

- Real Estate

- /

- NSEI:PURVA

Lacklustre Performance Is Driving Puravankara Limited's (NSE:PURVA) 28% Price Drop

To the annoyance of some shareholders, Puravankara Limited (NSE:PURVA) shares are down a considerable 28% in the last month, which continues a horrid run for the company. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 13%.

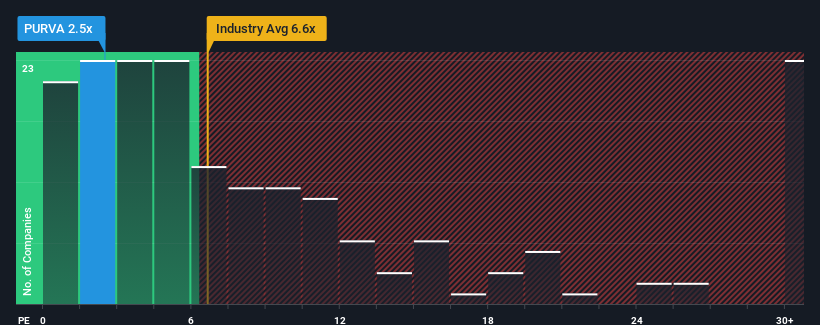

Even after such a large drop in price, Puravankara may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.5x, since almost half of all companies in the Real Estate industry in India have P/S ratios greater than 6.6x and even P/S higher than 20x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Puravankara

What Does Puravankara's Recent Performance Look Like?

Puravankara certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Puravankara's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Puravankara?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Puravankara's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 83% last year. The latest three year period has also seen an excellent 167% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 0.2% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 39%, which is noticeably more attractive.

With this in consideration, its clear as to why Puravankara's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Shares in Puravankara have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Puravankara's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 3 warning signs we've spotted with Puravankara (including 2 which shouldn't be ignored).

If you're unsure about the strength of Puravankara's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PURVA

Puravankara

Designs, develops, constructs, and markets residential and commercial properties in India.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives