- India

- /

- Real Estate

- /

- NSEI:ELDEHSG

Has Eldeco Housing and Industries Limited's (NSE:ELDEHSG) Impressive Stock Performance Got Anything to Do With Its Fundamentals?

Eldeco Housing and Industries' (NSE:ELDEHSG) stock is up by a considerable 10% over the past week. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on Eldeco Housing and Industries' ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Eldeco Housing and Industries

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Eldeco Housing and Industries is:

9.1% = ₹339m ÷ ₹3.7b (Based on the trailing twelve months to March 2024).

The 'return' is the profit over the last twelve months. So, this means that for every ₹1 of its shareholder's investments, the company generates a profit of ₹0.09.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Eldeco Housing and Industries' Earnings Growth And 9.1% ROE

When you first look at it, Eldeco Housing and Industries' ROE doesn't look that attractive. However, the fact that the company's ROE is higher than the average industry ROE of 6.6%, is definitely interesting. However, Eldeco Housing and Industries has seen a flattish net income growth over the past five years, which is not saying much. Bear in mind, the company does have a slightly low ROE. It is just that the industry ROE is lower. Therefore, the low to flat growth in earnings could also be the result of this.

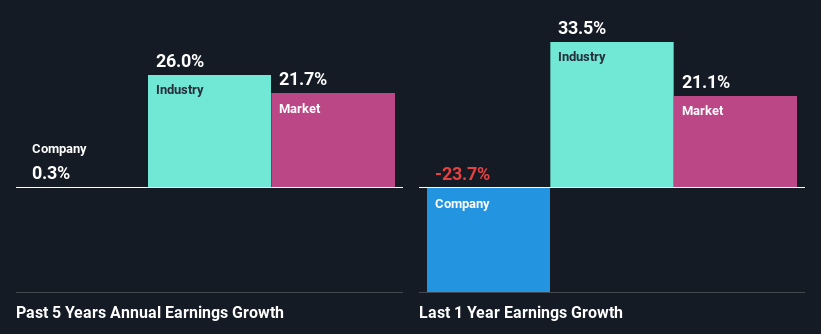

We then compared Eldeco Housing and Industries' net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 26% in the same 5-year period, which is a bit concerning.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Eldeco Housing and Industries''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Eldeco Housing and Industries Efficiently Re-investing Its Profits?

Eldeco Housing and Industries' low three-year median payout ratio of 17%, (meaning the company retains83% of profits) should mean that the company is retaining most of its earnings and consequently, should see higher growth than it has reported.

Moreover, Eldeco Housing and Industries has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Summary

In total, it does look like Eldeco Housing and Industries has some positive aspects to its business. Although, we are disappointed to see a lack of growth in earnings even in spite of a moderate ROE and and a high reinvestment rate. We believe that there might be some outside factors that could be having a negative impact on the business. So far, we've only made a quick discussion around the company's earnings growth. You can do your own research on Eldeco Housing and Industries and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

Valuation is complex, but we're here to simplify it.

Discover if Eldeco Housing and Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ELDEHSG

Eldeco Housing and Industries

Engages in the development of real estate properties in India.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives