Earnings Not Telling The Story For Zydus Lifesciences Limited (NSE:ZYDUSLIFE) After Shares Rise 28%

Zydus Lifesciences Limited (NSE:ZYDUSLIFE) shares have continued their recent momentum with a 28% gain in the last month alone. The last month tops off a massive increase of 102% in the last year.

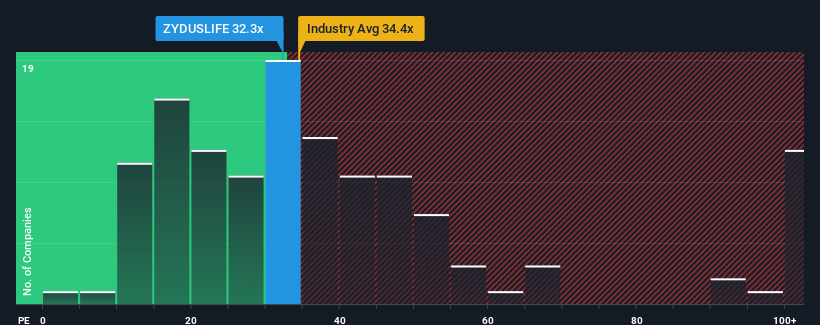

In spite of the firm bounce in price, there still wouldn't be many who think Zydus Lifesciences' price-to-earnings (or "P/E") ratio of 32.3x is worth a mention when the median P/E in India is similar at about 32x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's superior to most other companies of late, Zydus Lifesciences has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Zydus Lifesciences

Does Growth Match The P/E?

In order to justify its P/E ratio, Zydus Lifesciences would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 43% gain to the company's bottom line. The latest three year period has also seen an excellent 62% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 6.5% per year as estimated by the analysts watching the company. With the market predicted to deliver 19% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's curious that Zydus Lifesciences' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

Zydus Lifesciences appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Zydus Lifesciences' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 1 warning sign for Zydus Lifesciences that we have uncovered.

You might be able to find a better investment than Zydus Lifesciences. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zydus Lifesciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ZYDUSLIFE

Zydus Lifesciences

Engages in the research, development, production, marketing, distribution, and sale of pharmaceutical products in India, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives