Zota Health Care (NSE:ZOTA) Has Re-Affirmed Its Dividend Of ₹1.00

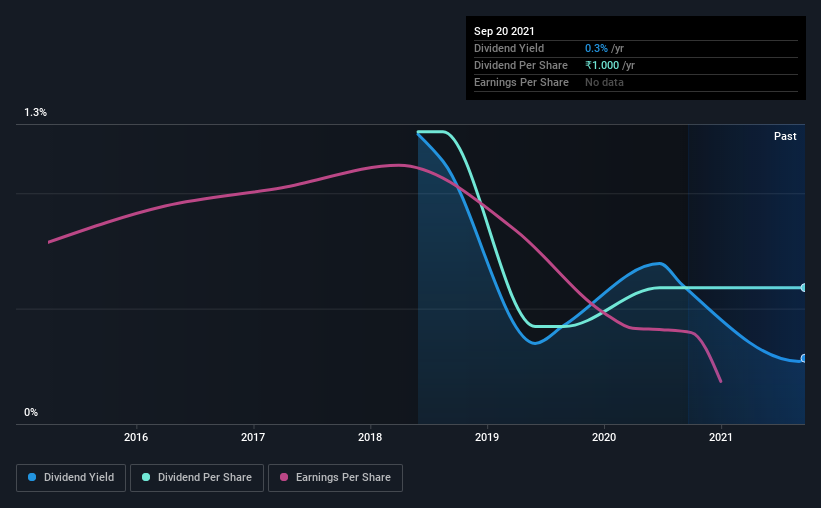

Zota Health Care Limited's (NSE:ZOTA) investors are due to receive a payment of ₹1.00 per share on 30th of October. Including this payment, the dividend yield on the stock will be 0.3%, which is a modest boost for shareholders' returns.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Zota Health Care's stock price has increased by 87% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

View our latest analysis for Zota Health Care

Zota Health Care Is Paying Out More Than It Is Earning

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Based on the last payment, Zota Health Care's profits didn't cover the dividend, but the company was generating enough cash instead. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

If the company can't turn things around, EPS could fall by 27.9% over the next year. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 279%, which is definitely a bit high to be sustainable going forward.

Zota Health Care's Dividend Has Lacked Consistency

The track record isn't the longest, but we are already seeing a bit of instability in the payments. Since 2018, the dividend has gone from ₹2.14 to ₹1.00. Dividend payments have fallen sharply, down 53% over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Potential Is Shaky

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Earnings per share has been sinking by 28% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 6 warning signs for Zota Health Care (1 is potentially serious!) that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

When trading Zota Health Care or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zota Health Care might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ZOTA

Zota Health Care

Develops, manufactures, and markets pharmaceutical products in India and internationally.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives