What Wockhardt Limited's (NSE:WOCKPHARMA) 31% Share Price Gain Is Not Telling You

Despite an already strong run, Wockhardt Limited (NSE:WOCKPHARMA) shares have been powering on, with a gain of 31% in the last thirty days. The last month tops off a massive increase of 265% in the last year.

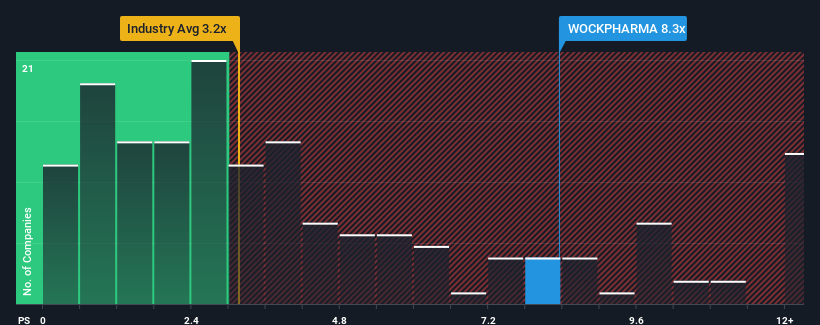

After such a large jump in price, given around half the companies in India's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 3.2x, you may consider Wockhardt as a stock to avoid entirely with its 8.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Wockhardt

How Has Wockhardt Performed Recently?

The recent revenue growth at Wockhardt would have to be considered satisfactory if not spectacular. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Wockhardt will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

Wockhardt's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.5%. Still, lamentably revenue has fallen 4.4% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 15% shows it's an unpleasant look.

With this information, we find it concerning that Wockhardt is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

The strong share price surge has lead to Wockhardt's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Wockhardt currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Wockhardt (1 is potentially serious!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Wockhardt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:WOCKPHARMA

Wockhardt

A pharmaceutical and biotech company, manufactures and trades pharmaceuticals, medicinal, botanical, and chemical products in India, the United States, the United Kingdom, Switzerland, Ireland, Russia, Europe, and internationally.

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives