Subdued Growth No Barrier To Wockhardt Limited (NSE:WOCKPHARMA) With Shares Advancing 29%

Despite an already strong run, Wockhardt Limited (NSE:WOCKPHARMA) shares have been powering on, with a gain of 29% in the last thirty days. The last month tops off a massive increase of 200% in the last year.

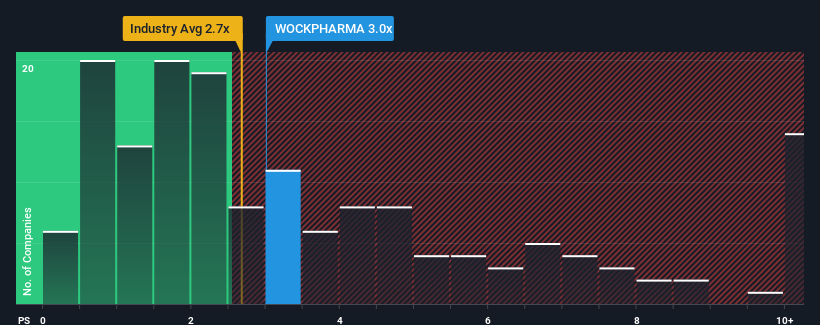

In spite of the firm bounce in price, it's still not a stretch to say that Wockhardt's price-to-sales (or "P/S") ratio of 3x right now seems quite "middle-of-the-road" compared to the Pharmaceuticals industry in India, where the median P/S ratio is around 2.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Wockhardt

How Wockhardt Has Been Performing

Wockhardt has been doing a decent job lately as it's been growing revenue at a reasonable pace. It might be that many expect the respectable revenue performance to only match most other companies over the coming period, which has kept the P/S from rising. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Wockhardt will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Wockhardt's to be considered reasonable.

Retrospectively, the last year delivered a decent 5.6% gain to the company's revenues. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 12% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Wockhardt's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does Wockhardt's P/S Mean For Investors?

Wockhardt appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Wockhardt's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

It is also worth noting that we have found 3 warning signs for Wockhardt (2 are a bit unpleasant!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wockhardt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:WOCKPHARMA

Wockhardt

A pharmaceutical and biotech company, manufactures and trades pharmaceuticals, medicinal, botanical, and chemical products in India, the United States, the United Kingdom, Switzerland, Ireland, Russia, Europe, and internationally.

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives