Increases to Themis Medicare Limited's (NSE:THEMISMED) CEO Compensation Might Cool off for now

Performance at Themis Medicare Limited (NSE:THEMISMED) has been reasonably good and CEO Sachin Patel has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 18 September 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

Check out our latest analysis for Themis Medicare

How Does Total Compensation For Sachin Patel Compare With Other Companies In The Industry?

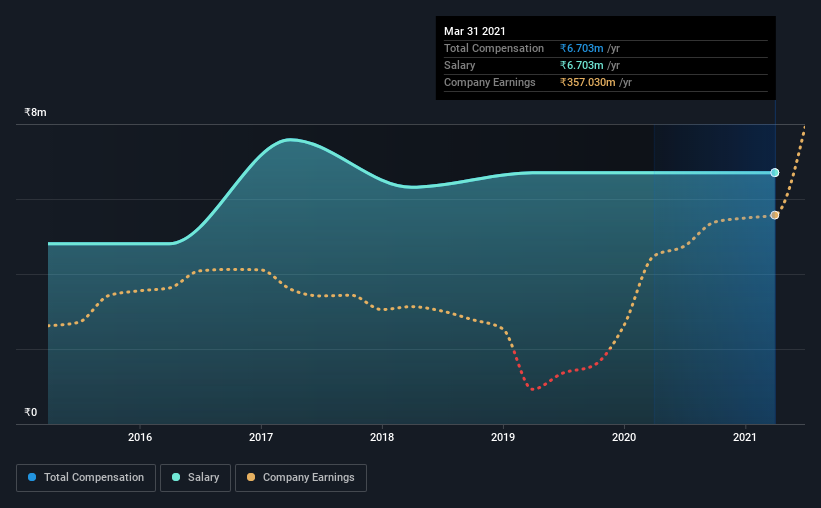

At the time of writing, our data shows that Themis Medicare Limited has a market capitalization of ₹9.3b, and reported total annual CEO compensation of ₹6.7m for the year to March 2021. This was the same amount the CEO received in the prior year. Notably, the salary of ₹6.7m is the entirety of the CEO compensation.

For comparison, other companies in the industry with market capitalizations below ₹15b, reported a median total CEO compensation of ₹3.0m. This suggests that Sachin Patel is paid more than the median for the industry. Moreover, Sachin Patel also holds ₹560m worth of Themis Medicare stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹6.7m | ₹6.7m | 100% |

| Other | - | - | - |

| Total Compensation | ₹6.7m | ₹6.7m | 100% |

Speaking on an industry level, nearly 92% of total compensation represents salary, while the remainder of 8% is other remuneration. At the company level, Themis Medicare pays Sachin Patel solely through a salary, preferring to go down a conventional route. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Themis Medicare Limited's Growth

Themis Medicare Limited's earnings per share (EPS) grew 80% per year over the last three years. It achieved revenue growth of 48% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Themis Medicare Limited Been A Good Investment?

We think that the total shareholder return of 193%, over three years, would leave most Themis Medicare Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Themis Medicare pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Themis Medicare that investors should think about before committing capital to this stock.

Switching gears from Themis Medicare, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Themis Medicare, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Themis Medicare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:THEMISMED

Themis Medicare

Manufactures and sells pharmaceutical products in India and internationally.

Flawless balance sheet with questionable track record.