- India

- /

- Entertainment

- /

- NSEI:PVRINOX

Indian Stocks Estimated Below Fair Value In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has experienced a 4.7% drop, though it remains up by 39% over the past year with earnings projected to grow by 17% annually in the coming years. In this context, identifying stocks that are currently estimated below their fair value can offer potential opportunities for investors seeking to capitalize on future growth prospects amidst recent market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1111.10 | ₹2151.98 | 48.4% |

| RITES (NSEI:RITES) | ₹300.35 | ₹517.93 | 42% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹440.55 | ₹762.32 | 42.2% |

| Vedanta (NSEI:VEDL) | ₹497.45 | ₹899.83 | 44.7% |

| Patel Engineering (BSE:531120) | ₹54.99 | ₹91.78 | 40.1% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹265.70 | ₹445.15 | 40.3% |

| Orchid Pharma (NSEI:ORCHPHARMA) | ₹1331.35 | ₹2142.32 | 37.9% |

| Tarsons Products (NSEI:TARSONS) | ₹427.35 | ₹708.94 | 39.7% |

| Manorama Industries (BSE:541974) | ₹835.90 | ₹1665.51 | 49.8% |

| Strides Pharma Science (NSEI:STAR) | ₹1443.80 | ₹2704.30 | 46.6% |

Let's review some notable picks from our screened stocks.

PVR INOX (NSEI:PVRINOX)

Overview: PVR INOX Limited is a theatrical exhibition company involved in the exhibition, distribution, and production of movies in India and Sri Lanka, with a market cap of ₹157.39 billion.

Operations: The company's revenue primarily comes from the movie exhibition segment, which generated ₹59.48 billion.

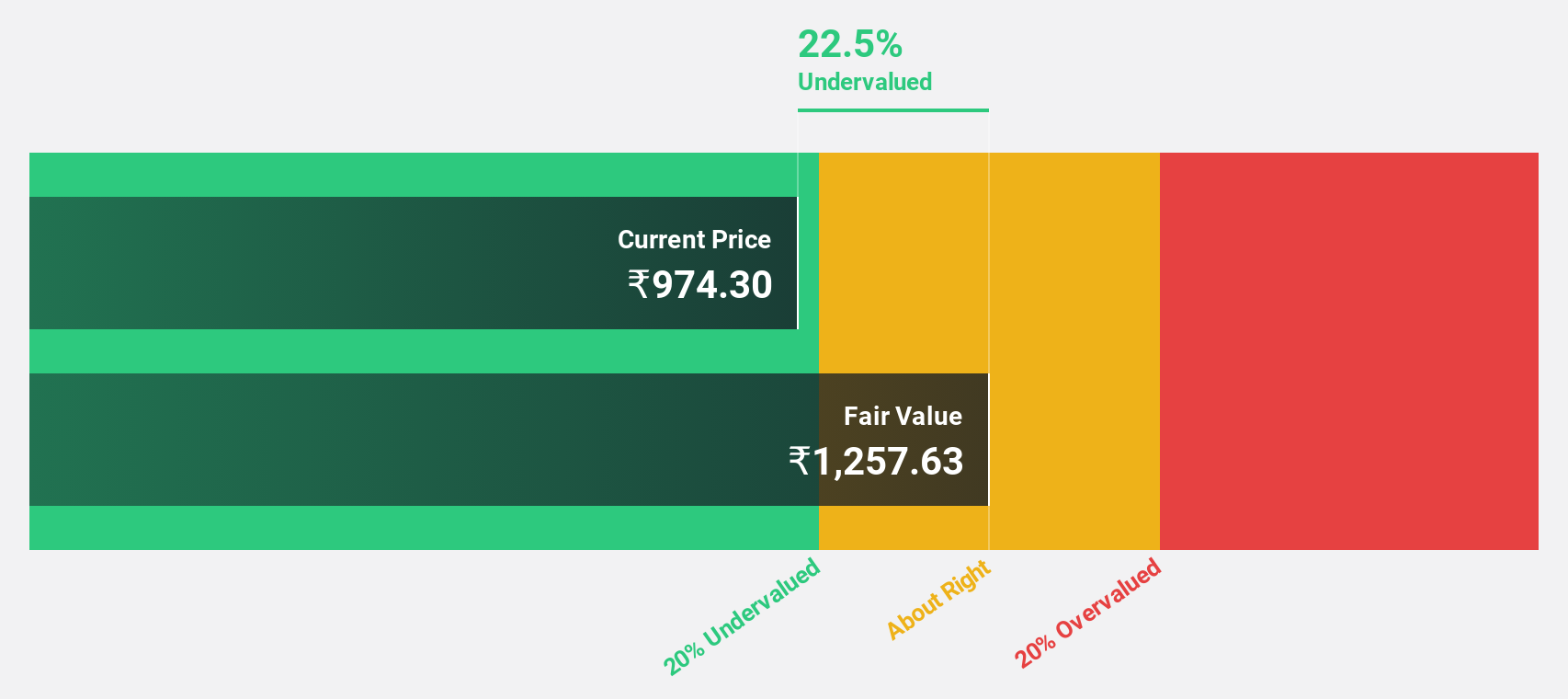

Estimated Discount To Fair Value: 12.3%

PVR INOX is trading at ₹1603.85, slightly below its estimated fair value of ₹1827.79, indicating potential undervaluation based on discounted cash flow analysis. Despite recent financial challenges, including a net loss of INR 1.79 billion in Q1 2024, the company's earnings are forecast to grow significantly at 60% annually. Recent expansions in Coimbatore and Mohali enhance its market presence and could support future revenue growth, which is expected to outpace the Indian market average.

- According our earnings growth report, there's an indication that PVR INOX might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of PVR INOX.

RITES (NSEI:RITES)

Overview: RITES Limited, along with its subsidiaries, offers design, engineering consultancy, and project management services across sectors such as railways, highways, airports, metros, ports, ropeways, urban transport, inland waterways and renewable energy with a market cap of ₹144.35 billion.

Operations: The company's revenue segments include Export Sale at ₹699 million, Power Generation at ₹177.80 million, Leasing - Domestic at ₹1.41 billion, Consultancy - Abroad at ₹766.10 million, Consultancy - Domestic at ₹11.79 billion, and Turnkey Construction Projects - Domestic at ₹9.10 billion.

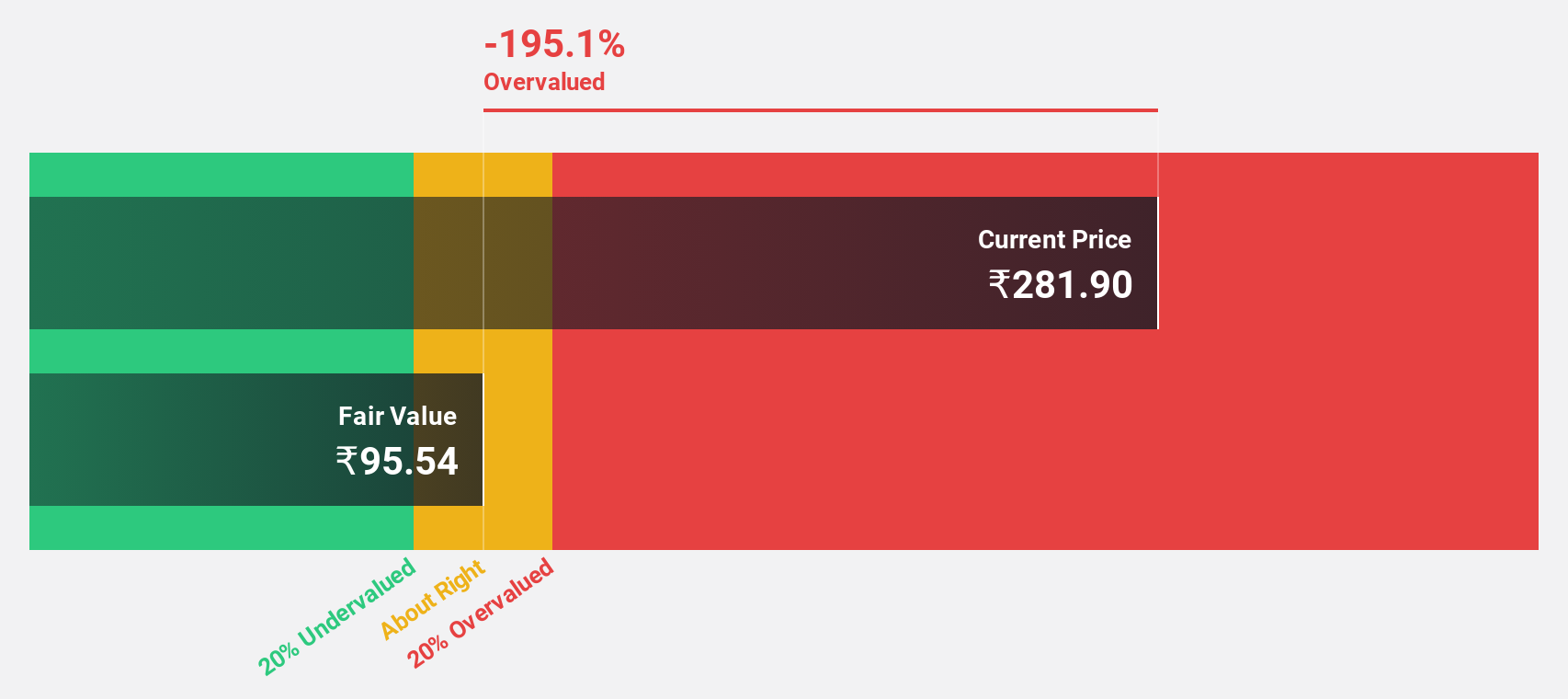

Estimated Discount To Fair Value: 42%

RITES is trading at ₹300.35, significantly below its estimated fair value of ₹517.93, suggesting it may be undervalued based on cash flows. The company's earnings and revenue are forecasted to grow at 23.5% and 20.6% annually, respectively, outpacing the Indian market averages. Recent international contracts worth US$5.40 million and strategic partnerships with entities like DMRC bolster its growth prospects despite tax-related challenges impacting financials temporarily.

- The growth report we've compiled suggests that RITES' future prospects could be on the up.

- Get an in-depth perspective on RITES' balance sheet by reading our health report here.

Strides Pharma Science (NSEI:STAR)

Overview: Strides Pharma Science Limited develops, manufactures, and sells pharmaceutical products across Africa, Australia, North America, Europe, Asia, India, and internationally with a market cap of ₹132.77 billion.

Operations: The company's revenue from its pharmaceutical business, excluding the bio-pharmaceutical segment, is ₹42.09 billion.

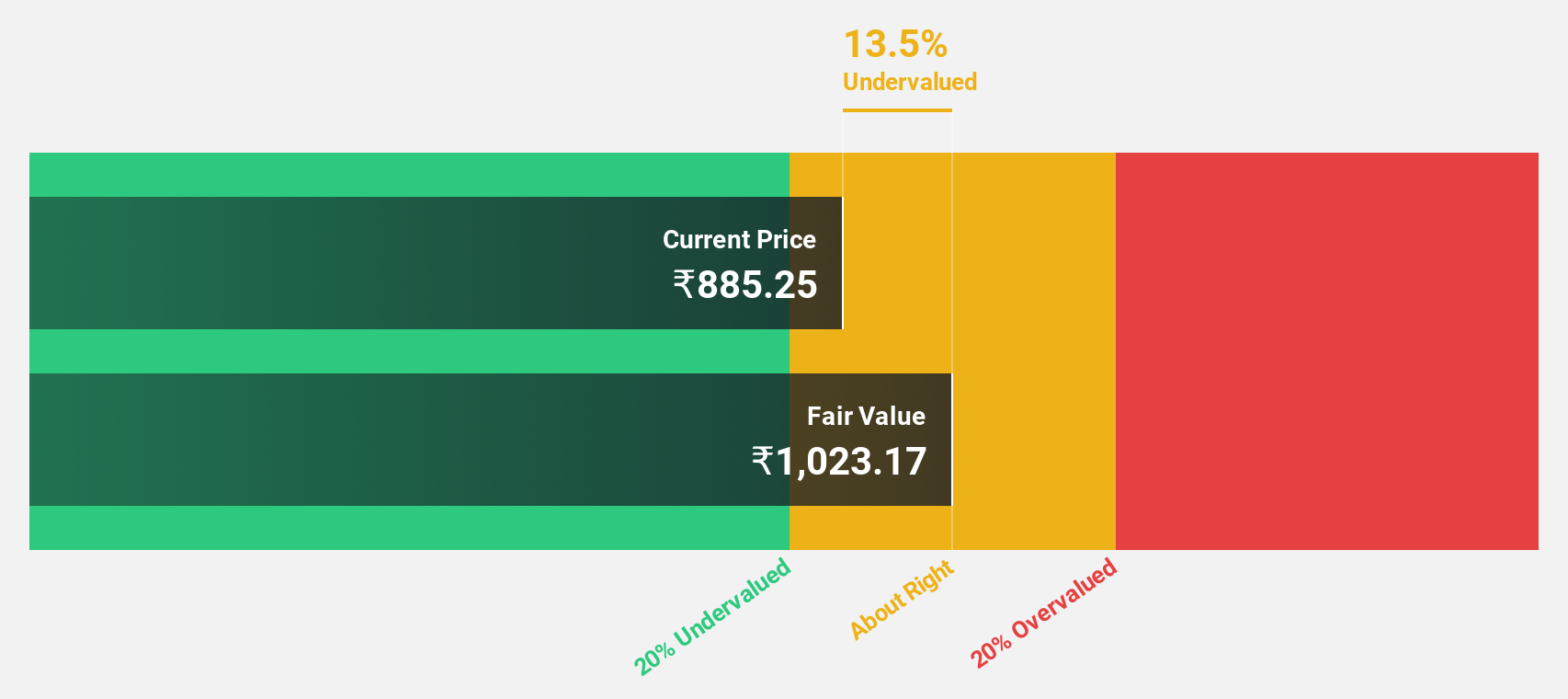

Estimated Discount To Fair Value: 46.6%

Strides Pharma Science, trading at ₹1,443.8, is highly undervalued with a fair value estimate of ₹2,704.3 based on discounted cash flow analysis. Revenue growth is projected to outpace the Indian market at 11% annually, with earnings expected to surge by over 65% per year. Recent debt reduction efforts have decreased outstanding non-convertible debentures significantly from an initial ₹1.25 billion to ₹242 million, enhancing financial stability and future profitability prospects.

- Upon reviewing our latest growth report, Strides Pharma Science's projected financial performance appears quite optimistic.

- Dive into the specifics of Strides Pharma Science here with our thorough financial health report.

Make It Happen

- Delve into our full catalog of 30 Undervalued Indian Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PVRINOX

PVR INOX

A theatrical exhibition company, engages in the exhibition, distribution, and production of movies in India and Sri Lanka.

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026