Over the last 7 days, the Indian market has dropped 4.7%, although it remains up 39% over the past year with earnings forecast to grow by 17% annually. In this context, identifying undervalued stocks that offer strong fundamentals and growth potential can be a strategic move for investors looking to capitalize on market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shyam Metalics and Energy (NSEI:SHYAMMETL) | ₹737.00 | ₹1127.99 | 34.7% |

| NIIT Learning Systems (NSEI:NIITMTS) | ₹473.45 | ₹713.05 | 33.6% |

| HEG (NSEI:HEG) | ₹2050.70 | ₹3912.68 | 47.6% |

| S Chand (NSEI:SCHAND) | ₹223.59 | ₹356.28 | 37.2% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1392.10 | ₹2167.50 | 35.8% |

| Updater Services (NSEI:UDS) | ₹320.90 | ₹630.87 | 49.1% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹912.30 | ₹1509.79 | 39.6% |

| Texmaco Rail & Engineering (NSEI:TEXRAIL) | ₹252.15 | ₹396.33 | 36.4% |

| Piramal Pharma (NSEI:PPLPHARMA) | ₹179.34 | ₹289.56 | 38.1% |

| Strides Pharma Science (NSEI:STAR) | ₹1114.90 | ₹2032.10 | 45.1% |

Let's dive into some prime choices out of the screener.

Prataap Snacks (NSEI:DIAMONDYD)

Overview: Prataap Snacks Limited operates a snacks food business in India and internationally, with a market cap of ₹21.78 billion.

Operations: Prataap Snacks Limited generates revenue primarily from its snacks food segment, amounting to ₹16.52 billion.

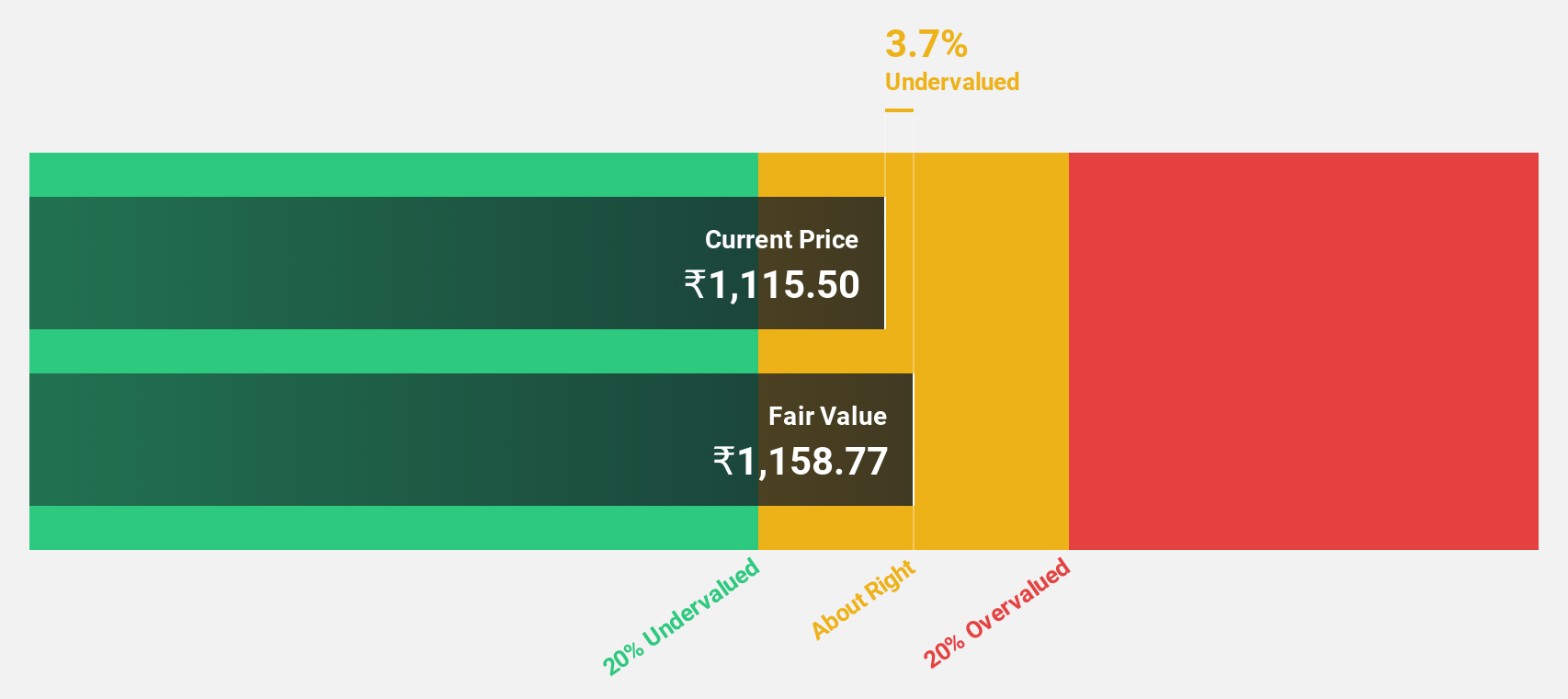

Estimated Discount To Fair Value: 39.6%

Prataap Snacks appears undervalued based on cash flows, trading significantly below its estimated fair value. Despite recent executive changes and a dip in net income for Q1 2024 to ₹94.39 million from ₹134.25 million a year ago, the company’s sales increased to ₹4.19 billion from ₹3.86 billion year-on-year. The stock's potential lies in its strong revenue growth and substantial undervaluation, making it an interesting consideration for investors focused on cash flow metrics.

- In light of our recent growth report, it seems possible that Prataap Snacks' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Prataap Snacks.

Piramal Pharma (NSEI:PPLPHARMA)

Overview: Piramal Pharma Limited operates as a pharmaceutical company in North America, Europe, Japan, India, and internationally with a market cap of ₹237.76 billion.

Operations: The company's revenue is primarily derived from its pharmaceutical segment, amounting to ₹83.73 billion.

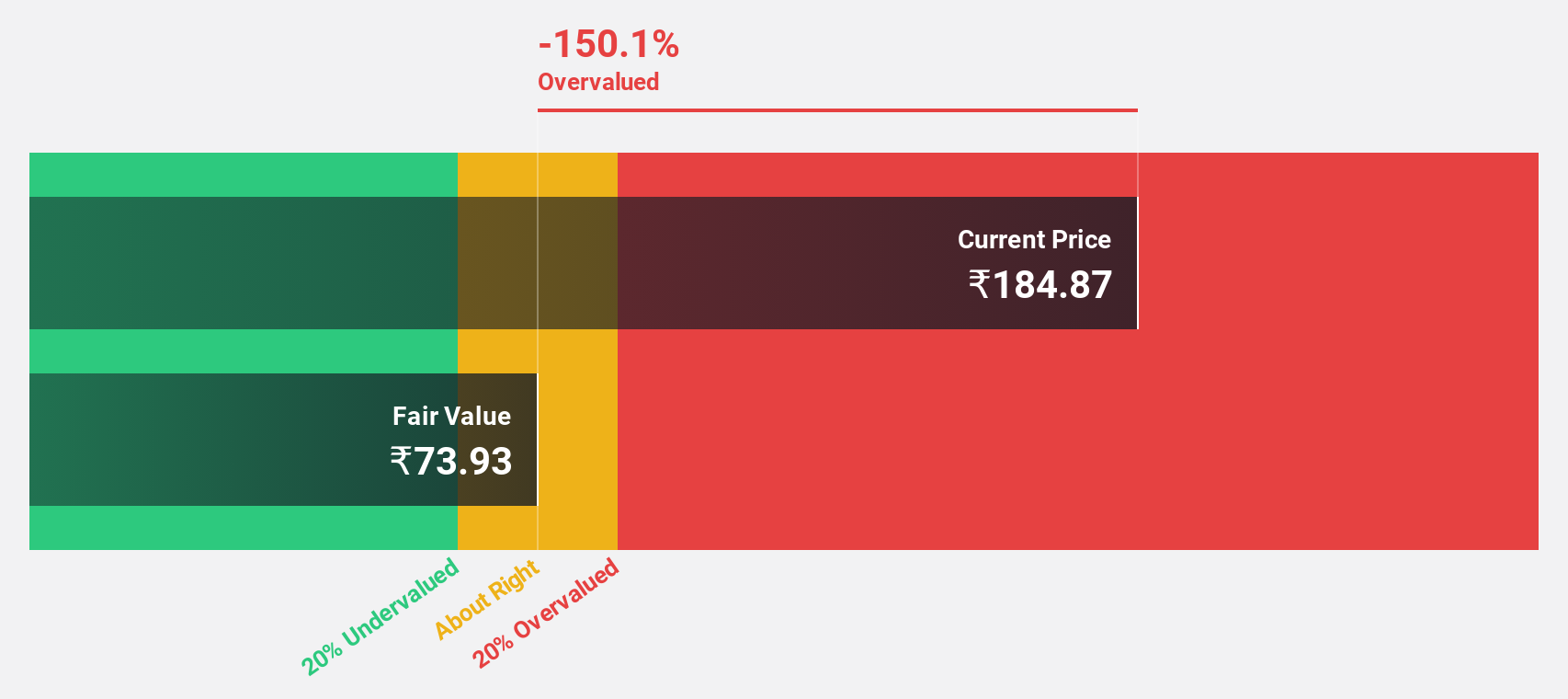

Estimated Discount To Fair Value: 38.1%

Piramal Pharma is trading at ₹179.34, significantly below its estimated fair value of ₹289.56, indicating it may be undervalued based on cash flows. Despite a net loss of ₹886.4 million in Q1 2024, the company has shown revenue growth to ₹19,706.8 million from ₹17,871.6 million year-on-year and became profitable this year with annual earnings expected to grow substantially over the next three years. However, interest payments are not well covered by earnings and shareholders have faced dilution recently.

- Our comprehensive growth report raises the possibility that Piramal Pharma is poised for substantial financial growth.

- Take a closer look at Piramal Pharma's balance sheet health here in our report.

Strides Pharma Science (NSEI:STAR)

Overview: Strides Pharma Science Limited develops, manufactures, and sells pharmaceutical products globally with a market cap of ₹102.52 billion.

Operations: The company generates ₹42.09 billion in revenue from its pharmaceutical business, excluding the bio-pharmaceutical segment.

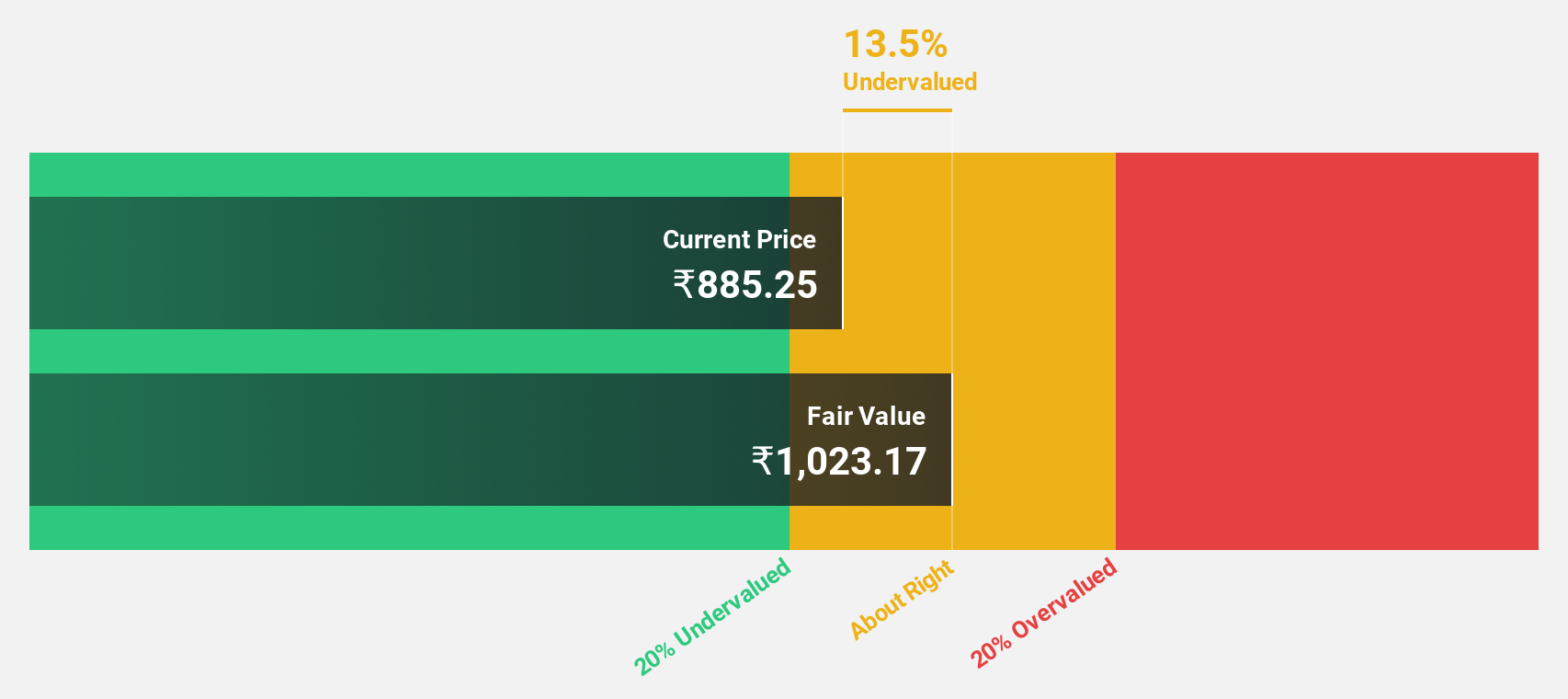

Estimated Discount To Fair Value: 45.1%

Strides Pharma Science, trading at ₹1114.9, is significantly undervalued with a fair value estimate of ₹2032.1. The company has shown strong revenue growth, reporting sales of ₹10.88 billion in Q1 2024 compared to ₹9.30 billion a year ago and turned profitable with net income of ₹702 million from a previous loss of ₹71 million. Despite recent executive changes, the stock's valuation based on cash flows remains attractive relative to peers and industry standards.

- According our earnings growth report, there's an indication that Strides Pharma Science might be ready to expand.

- Get an in-depth perspective on Strides Pharma Science's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Embark on your investment journey to our 27 Undervalued Indian Stocks Based On Cash Flows selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DIAMONDYD

Prataap Snacks

Manufactures and sells packaged snacks in India and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.