Solara Active Pharma Sciences Limited (NSE:SOLARAPP) Could Be Riskier Than It Looks

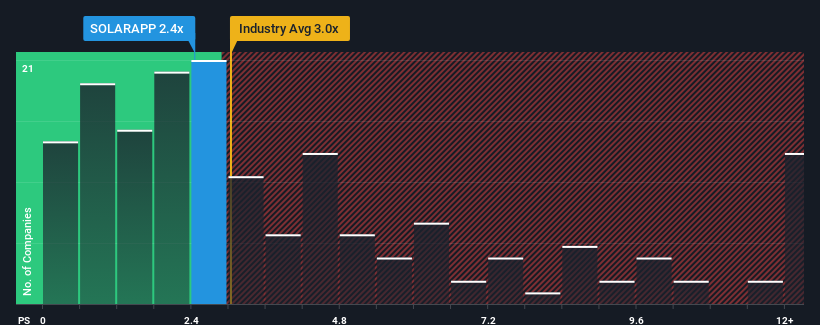

With a median price-to-sales (or "P/S") ratio of close to 3x in the Pharmaceuticals industry in India, you could be forgiven for feeling indifferent about Solara Active Pharma Sciences Limited's (NSE:SOLARAPP) P/S ratio of 2.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Solara Active Pharma Sciences

How Has Solara Active Pharma Sciences Performed Recently?

While the industry has experienced revenue growth lately, Solara Active Pharma Sciences' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Solara Active Pharma Sciences' future stacks up against the industry? In that case, our free report is a great place to start.How Is Solara Active Pharma Sciences' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Solara Active Pharma Sciences' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 27% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 32% during the coming year according to the sole analyst following the company. That's shaping up to be materially higher than the 15% growth forecast for the broader industry.

In light of this, it's curious that Solara Active Pharma Sciences' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Solara Active Pharma Sciences' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Solara Active Pharma Sciences currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 1 warning sign for Solara Active Pharma Sciences that we have uncovered.

If you're unsure about the strength of Solara Active Pharma Sciences' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SOLARAPP

Solara Active Pharma Sciences

Manufactures, produces, processes, formulates, sells, imports, exports, merchandises, distributes, trades in, and deals in active pharmaceutical ingredients (API) in India, Asia Pacific, Europe, North America, South America, and internationally.

Undervalued with reasonable growth potential.