Investors Still Aren't Entirely Convinced By Solara Active Pharma Sciences Limited's (NSE:SOLARAPP) Revenues Despite 55% Price Jump

Solara Active Pharma Sciences Limited (NSE:SOLARAPP) shareholders would be excited to see that the share price has had a great month, posting a 55% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

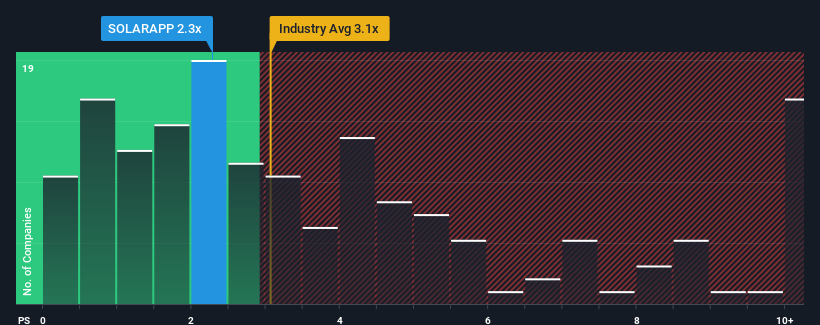

In spite of the firm bounce in price, Solara Active Pharma Sciences may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.3x, since almost half of all companies in the Pharmaceuticals industry in India have P/S ratios greater than 3.1x and even P/S higher than 6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Solara Active Pharma Sciences

What Does Solara Active Pharma Sciences' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Solara Active Pharma Sciences' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Solara Active Pharma Sciences' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Solara Active Pharma Sciences?

In order to justify its P/S ratio, Solara Active Pharma Sciences would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 22% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 22% over the next year. That's shaping up to be materially higher than the 12% growth forecast for the broader industry.

With this information, we find it odd that Solara Active Pharma Sciences is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift Solara Active Pharma Sciences' P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at Solara Active Pharma Sciences' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware Solara Active Pharma Sciences is showing 2 warning signs in our investment analysis, and 1 of those is potentially serious.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SOLARAPP1

Solara Active Pharma Sciences

Manufactures, produces, processes, formulates, sells, imports, exports, merchandises, distributes, trades in, and deals in active pharmaceutical ingredients (API) in India, Asia Pacific, Europe, North America, South America, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion