SMS Pharmaceuticals Limited's (NSE:SMSPHARMA) Stock is Soaring But Financials Seem Inconsistent: Will The Uptrend Continue?

SMS Pharmaceuticals (NSE:SMSPHARMA) has had a great run on the share market with its stock up by a significant 35% over the last three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. Particularly, we will be paying attention to SMS Pharmaceuticals' ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for SMS Pharmaceuticals

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for SMS Pharmaceuticals is:

8.7% = ₹319m ÷ ₹3.7b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every ₹1 worth of equity, the company was able to earn ₹0.09 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

SMS Pharmaceuticals' Earnings Growth And 8.7% ROE

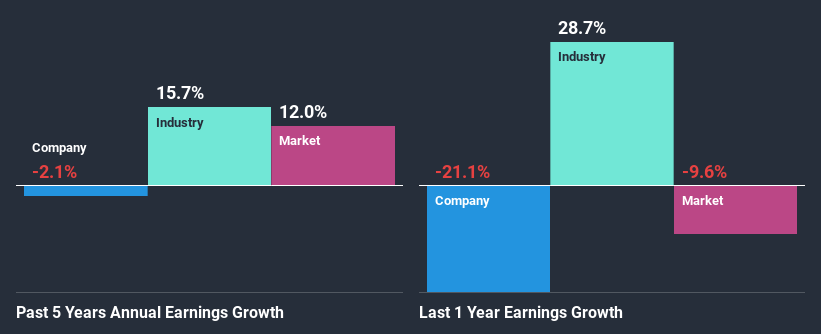

It is quite clear that SMS Pharmaceuticals' ROE is rather low. Not just that, even compared to the industry average of 14%, the company's ROE is entirely unremarkable. Given the circumstances, the significant decline in net income by 2.1% seen by SMS Pharmaceuticals over the last five years is not surprising. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

However, when we compared SMS Pharmaceuticals' growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 16% in the same period. This is quite worrisome.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is SMS Pharmaceuticals fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is SMS Pharmaceuticals Using Its Retained Earnings Effectively?

SMS Pharmaceuticals' low three-year median payout ratio of 6.0% (implying that it retains the remaining 94% of its profits) comes as a surprise when you pair it with the shrinking earnings. This typically shouldn't be the case when a company is retaining most of its earnings. So there could be some other explanations in that regard. For example, the company's business may be deteriorating.

In addition, SMS Pharmaceuticals has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth.

Conclusion

Overall, we have mixed feelings about SMS Pharmaceuticals. While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. You can see the 4 risks we have identified for SMS Pharmaceuticals by visiting our risks dashboard for free on our platform here.

If you decide to trade SMS Pharmaceuticals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SMSPHARMA

SMS Pharmaceuticals

Manufactures and sells active pharmaceutical ingredients (APIs) and its intermediates in India and internationally.

Proven track record with adequate balance sheet.