Does Par Drugs and Chemicals (NSE:PAR) Deserve A Spot On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Par Drugs and Chemicals (NSE:PAR). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Par Drugs and Chemicals

Par Drugs and Chemicals's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud Par Drugs and Chemicals's stratospheric annual EPS growth of 48%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

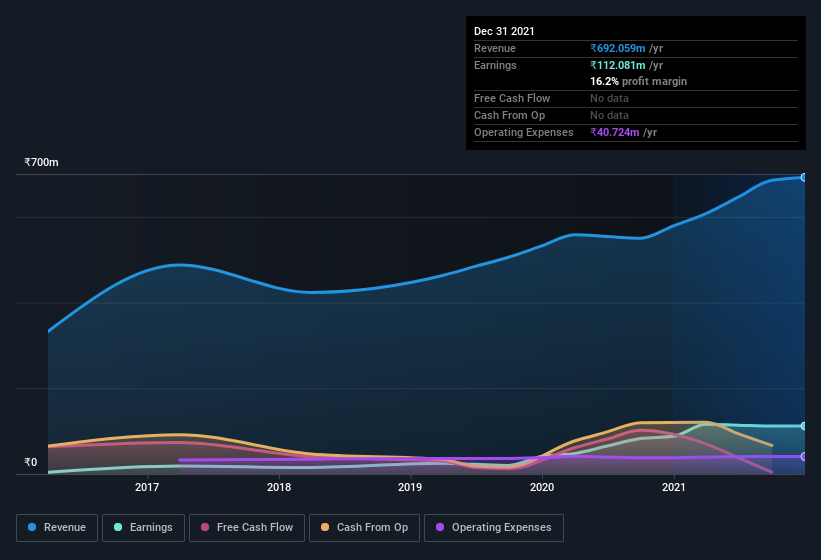

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note Par Drugs and Chemicals's EBIT margins were flat over the last year, revenue grew by a solid 20% to ₹692m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Par Drugs and Chemicals is no giant, with a market capitalization of ₹2.1b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Par Drugs and Chemicals Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that Par Drugs and Chemicals insiders spent ₹6.8m on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. Zooming in, we can see that the biggest insider purchase was by Whole Time Director Ghanshayambhai Savani for ₹561k worth of shares, at about ₹187 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Par Drugs and Chemicals insiders own more than a third of the company. Indeed, with a collective holding of 75%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about ₹1.5b riding on the stock, at current prices. That's nothing to sneeze at!

Is Par Drugs and Chemicals Worth Keeping An Eye On?

Par Drugs and Chemicals's earnings per share have taken off like a rocket aimed right at the moon. What's more insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Par Drugs and Chemicals deserves timely attention. You still need to take note of risks, for example - Par Drugs and Chemicals has 3 warning signs we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Par Drugs and Chemicals, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PAR

Par Drugs and Chemicals

Develops, manufactures, and sells active pharmaceutical ingredients (APIs) and fine chemicals in India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives