Do Par Drugs and Chemicals's (NSE:PAR) Earnings Warrant Your Attention?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Par Drugs and Chemicals (NSE:PAR). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Par Drugs and Chemicals

Par Drugs and Chemicals's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud Par Drugs and Chemicals's stratospheric annual EPS growth of 50%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

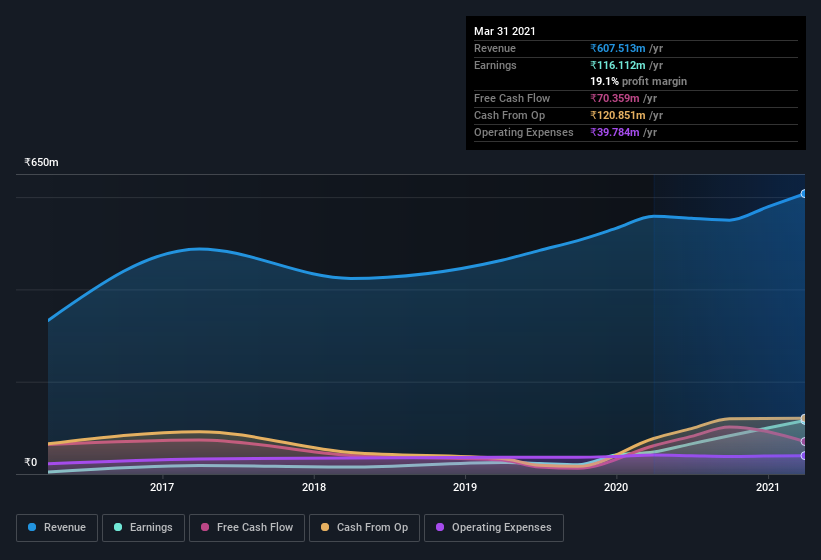

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Par Drugs and Chemicals shareholders can take confidence from the fact that EBIT margins are up from 12% to 22%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Par Drugs and Chemicals is no giant, with a market capitalization of ₹2.7b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Par Drugs and Chemicals Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One positive for Par Drugs and Chemicals, is that company insiders paid ₹1.3m for shares in the last year. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling. It is also worth noting that it was Chairman of the Board & MD Falgun Savani who made the biggest single purchase, worth ₹395k, paying ₹32.92 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Par Drugs and Chemicals insiders own more than a third of the company. In fact, they own 85% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about ₹2.3b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Is Par Drugs and Chemicals Worth Keeping An Eye On?

Par Drugs and Chemicals's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Par Drugs and Chemicals deserves timely attention. Even so, be aware that Par Drugs and Chemicals is showing 2 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Par Drugs and Chemicals, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Par Drugs and Chemicals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:PAR

Par Drugs and Chemicals

Develops, manufactures, and sells active pharmaceutical ingredients (APIs) and fine chemicals in India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives