- India

- /

- Metals and Mining

- /

- NSEI:JAIBALAJI

Exploring Undiscovered Gems In India For July 2024

Reviewed by Simply Wall St

The Indian stock market has experienced a notable trajectory, declining 1.3% over the past week but soaring 43% over the last year, with earnings projected to grow by 16% annually. In this dynamic environment, identifying stocks that have not yet caught the attention of mainstream investors can offer unique opportunities for growth.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pearl Global Industries | 54.72% | 19.34% | 38.59% | ★★★★★★ |

| Ingersoll-Rand (India) | NA | 14.12% | 26.31% | ★★★★★★ |

| Deep Industries | 10.38% | 10.66% | 28.71% | ★★★★★★ |

| Yuken India | 27.52% | 9.91% | -52.98% | ★★★★★★ |

| Force Motors | 23.24% | 17.79% | 29.78% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 38.22% | 31.27% | ★★★★★☆ |

| Nibe | 33.91% | 81.20% | 80.04% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| Master Trust | 37.05% | 26.63% | 41.10% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Jai Balaji Industries (NSEI:JAIBALAJI)

Simply Wall St Value Rating: ★★★★★★

Overview: Jai Balaji Industries Limited is a company based in India, primarily engaged in the manufacturing and marketing of iron and steel products, with a market capitalization of ₹14.83 billion.

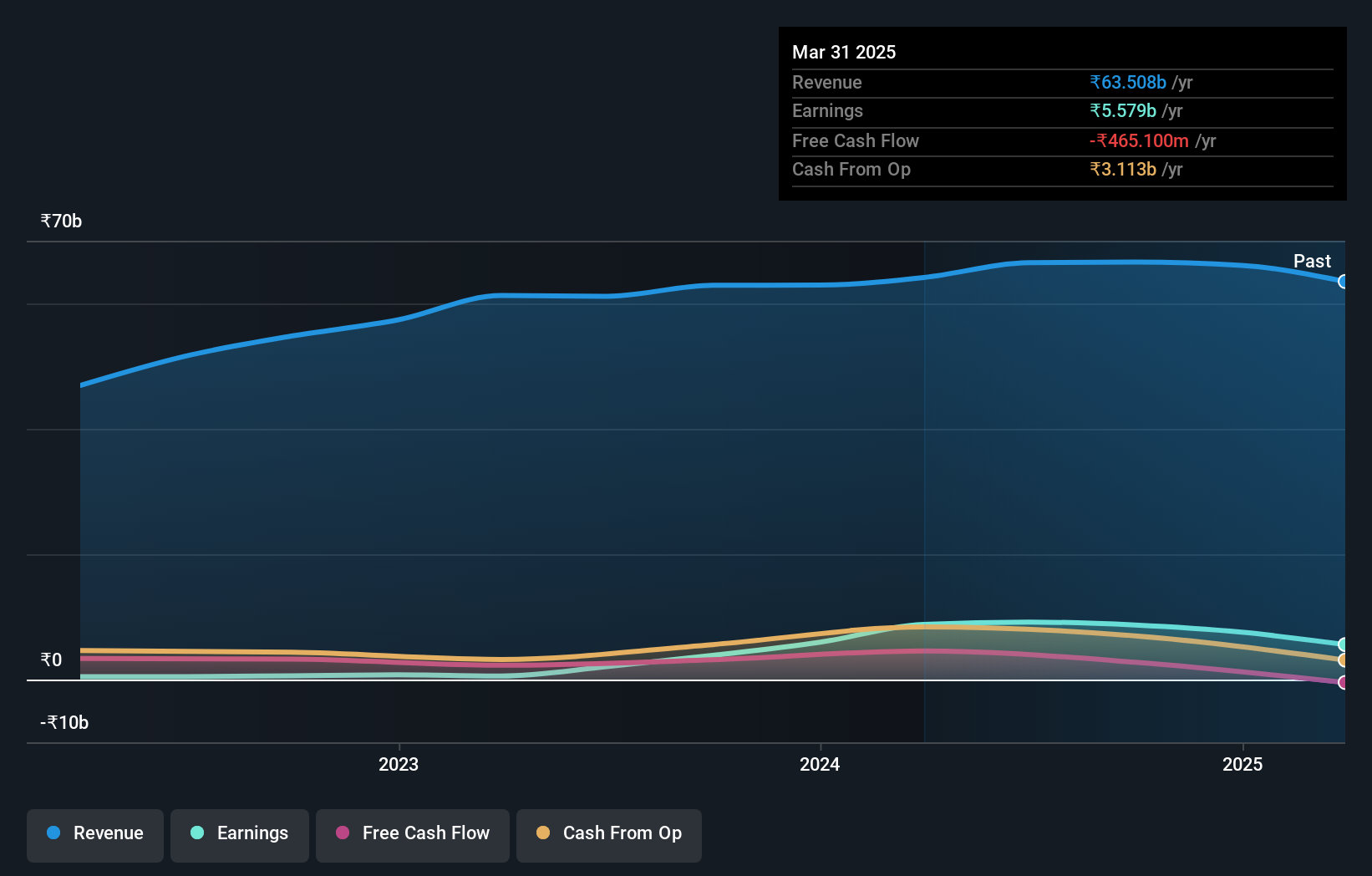

Operations: Jai Balaji Industries primarily operates in the iron and steel sector, generating a revenue of ₹64.14 billion as of the latest reporting period. The company has demonstrated a significant growth in gross profit margin, reaching 35.40% recently, reflecting an improvement in operational efficiency over time.

Jai Balaji Industries, a lesser-known yet promising player in the Indian metals and mining sector, showcases robust financial health with a price-to-earnings ratio of 17.7, well below the market average of 34.2. The company's earnings surged by an impressive 1420.9% last year, significantly outpacing its industry growth of 17.7%. With a satisfactory net debt to equity ratio at 25.3% and strong interest coverage (EBIT is 11.3 times interest payments), Jai Balaji combines financial prudence with high non-cash earnings, indicating quality and sustainability in its profitability.

- Click here and access our complete health analysis report to understand the dynamics of Jai Balaji Industries.

Understand Jai Balaji Industries' track record by examining our Past report.

Network People Services Technologies (NSEI:NPST)

Simply Wall St Value Rating: ★★★★★☆

Overview: Network People Services Technologies Limited specializes in creating digital payment solutions for banks, financial institutions, and merchants within the fintech sector in India, with a market capitalization of ₹45.88 billion.

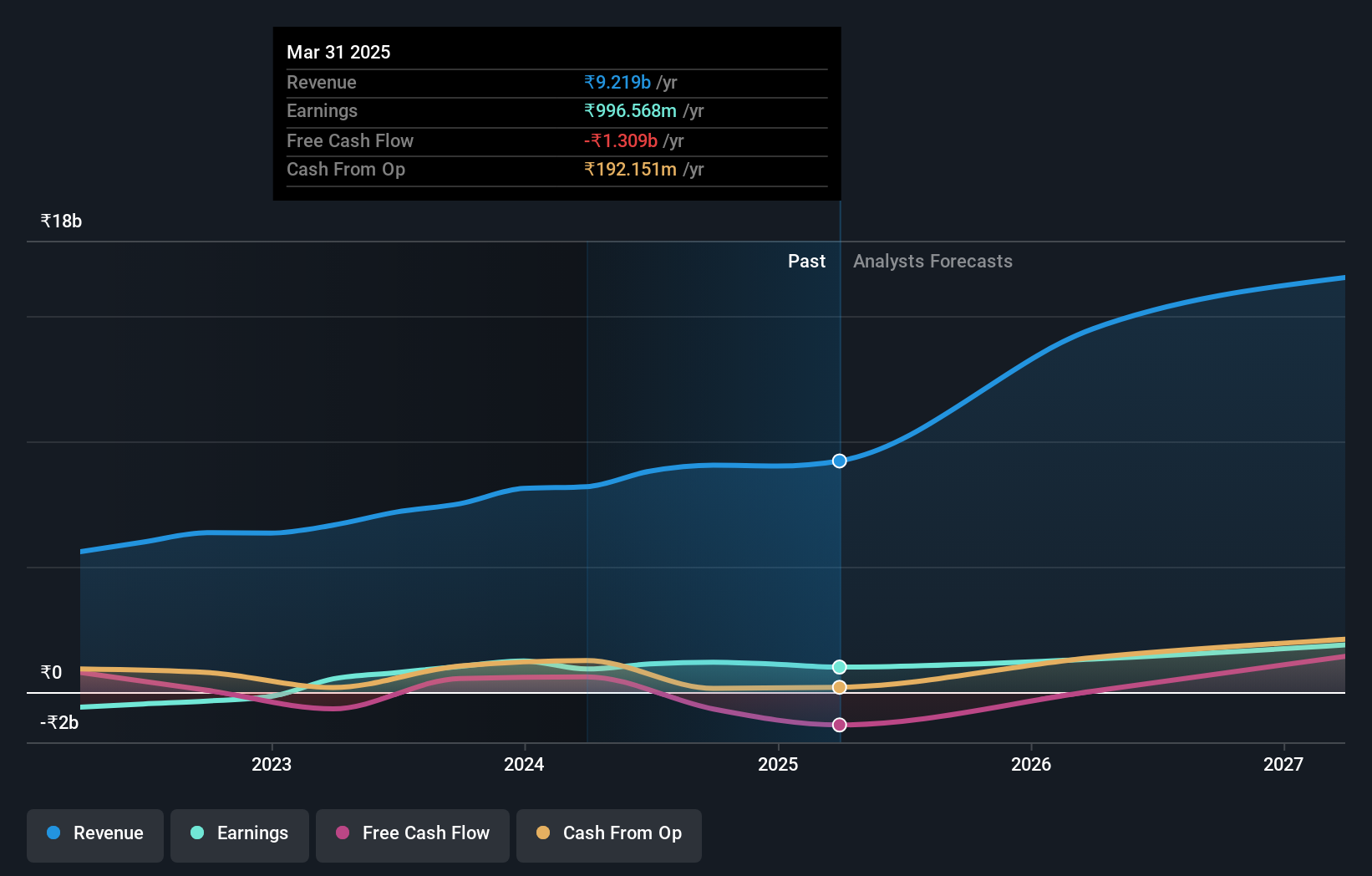

Operations: The company generates its revenue primarily from software and programming, achieving a notable gross profit margin of 40.20% as of mid-2024. This performance is supported by a consistent increase in revenue, reaching ₹1.62 billion by June 2024, with net income also showing robust growth to ₹371.89 million during the same period.

Network People Services Technologies, an emerging player in the diversified financial sector, has demonstrated robust growth with earnings soaring by 222.5% over the past year, significantly outpacing the industry's 21.3%. With a debt to equity ratio modestly rising from 0% to 0.2%, its financial leverage remains minimal. Recent achievements include securing a major contract for a mobile banking solution aimed at enhancing digital banking in rural areas, underscoring its innovative capabilities and potential for further expansion in untapped markets.

Orchid Pharma (NSEI:ORCHPHARMA)

Simply Wall St Value Rating: ★★★★★★

Overview: Orchid Pharma Limited is a pharmaceutical company based in India, specializing in the development, manufacture, and marketing of active pharmaceutical ingredients, bulk actives, finished dosage formulations, and nutraceuticals, with a market capitalization of ₹69.48 billion.

Operations: This pharmaceutical company generates revenue primarily through the sale of pharmaceutical products, with a recent reported revenue of ₹8.19 billion. The firm has demonstrated an ability to manage its gross profit margin, which stood at 40.87% as of the latest quarter, reflecting its operational efficiency in controlling the cost of goods sold relative to sales.

Orchid Pharma, an emerging leader in India's pharmaceutical sector, has shown robust performance with a 73.6% earnings growth surpassing the industry's 17%. With a solid EBIT coverage of 4.7 times its interest payments and positive free cash flow, the company is well-positioned financially. Recently, Orchid launched Cefepime-Enmetazobactam in collaboration with Cipla, addressing critical healthcare needs and showcasing its innovative capabilities in drug development. This strategic move enhances its market presence significantly.

- Click here to discover the nuances of Orchid Pharma with our detailed analytical health report.

Assess Orchid Pharma's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Delve into our full catalog of 453 Indian Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JAIBALAJI

Jai Balaji Industries

Manufactures and markets iron and steel products primarily in India.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives