- India

- /

- Auto Components

- /

- NSEI:SHRIPISTON

Undiscovered Gems in India to Watch This September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.2%, driven by a decline of 4.5%, yet it has risen by an impressive 38% over the past year with earnings forecast to grow by 17% annually. In light of these dynamic conditions, identifying stocks with strong growth potential and solid fundamentals can be particularly rewarding for investors looking to capitalize on India's evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wealth First Portfolio Managers | NA | -47.95% | 40.47% | ★★★★★★ |

| Bharat Rasayan | 8.15% | 0.10% | -7.93% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 42.61% | 42.95% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Master Trust | 37.05% | 27.64% | 41.99% | ★★★★★☆ |

| Ingersoll-Rand (India) | 1.05% | 14.88% | 27.54% | ★★★★★☆ |

| Genesys International | 12.13% | 15.75% | 36.33% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 31.02% | 50.24% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Alpex Solar (NSEI:ALPEXSOLAR)

Simply Wall St Value Rating: ★★★★☆☆

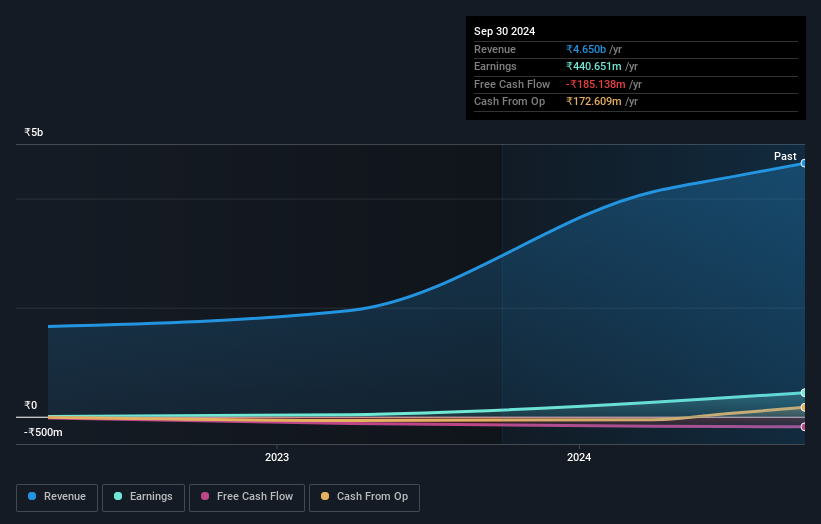

Overview: Alpex Solar Limited manufactures and sells power photovoltaic (PV) modules and solar systems in India, with a market cap of ₹21.79 billion.

Operations: Alpex Solar generates revenue primarily from its solar panel manufacturing, trading, and application segment, amounting to ₹4.04 billion. Another minor revenue stream comes from the import and trading of circular knitting needles and other items, contributing ₹81.77 million.

Alpex Solar's earnings surged by 601.7% over the past year, significantly outpacing the Semiconductor industry's 143.8%. With a Price-To-Earnings ratio of 82x, it appears undervalued compared to the industry average of 146.6x. The company has more cash than total debt and its EBIT covers interest payments by 5.5 times, indicating strong financial health. Recently, Gaurav Bector was appointed as Global Head of EPC, bringing extensive cross-functional experience from top multinationals like Siemens and ABB Ltd.

- Unlock comprehensive insights into our analysis of Alpex Solar stock in this health report.

Evaluate Alpex Solar's historical performance by accessing our past performance report.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

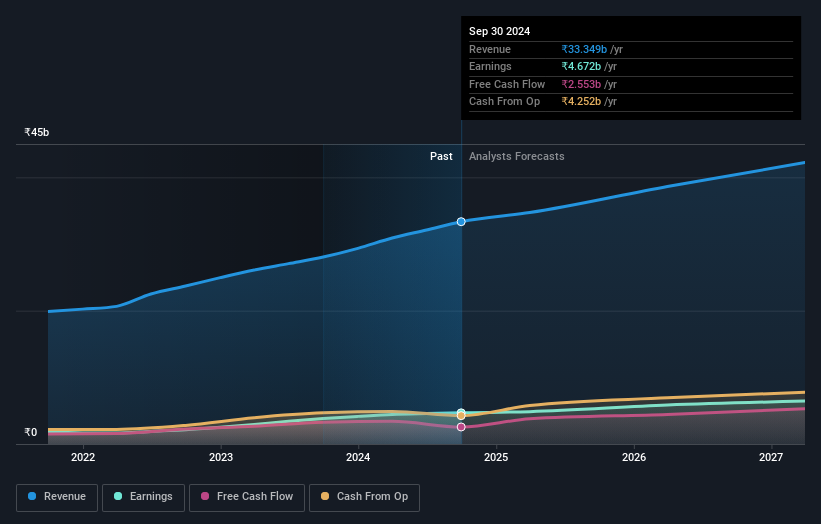

Overview: Marksans Pharma Limited, along with its subsidiaries, focuses on the research, manufacturing, marketing, and sale of pharmaceutical formulations across various international markets including the United States, North America, Europe, the United Kingdom, Australia, and New Zealand; it has a market cap of ₹119.45 billion.

Operations: Marksans Pharma generates revenue primarily from its pharmaceutical segment, which reported earnings of ₹22.68 billion. The company has a market cap of ₹119.45 billion.

Marksans Pharma, a noteworthy player in the pharmaceuticals sector, has shown robust performance with earnings growing 21.7% over the past year, outpacing the industry’s 19.2%. The company reported Q1 2025 net income of ₹887.52 million compared to ₹686.58 million last year and basic earnings per share rising to ₹1.96 from ₹1.52 previously. With a price-to-earnings ratio of 35.8x below the industry average of 43x and debt reduced from 19.9% to 11.7% over five years, Marksans is trading at good value while exploring M&A opportunities for European market expansion following successful USFDA inspection closure in Goa facility.

- Get an in-depth perspective on Marksans Pharma's performance by reading our health report here.

Explore historical data to track Marksans Pharma's performance over time in our Past section.

Shriram Pistons & Rings (NSEI:SHRIPISTON)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shriram Pistons & Rings Limited manufactures and sells automotive components in India, with a market cap of ₹103.42 billion.

Operations: Shriram Pistons & Rings Limited generates revenue primarily from the sale of automotive components, amounting to ₹32.10 billion.

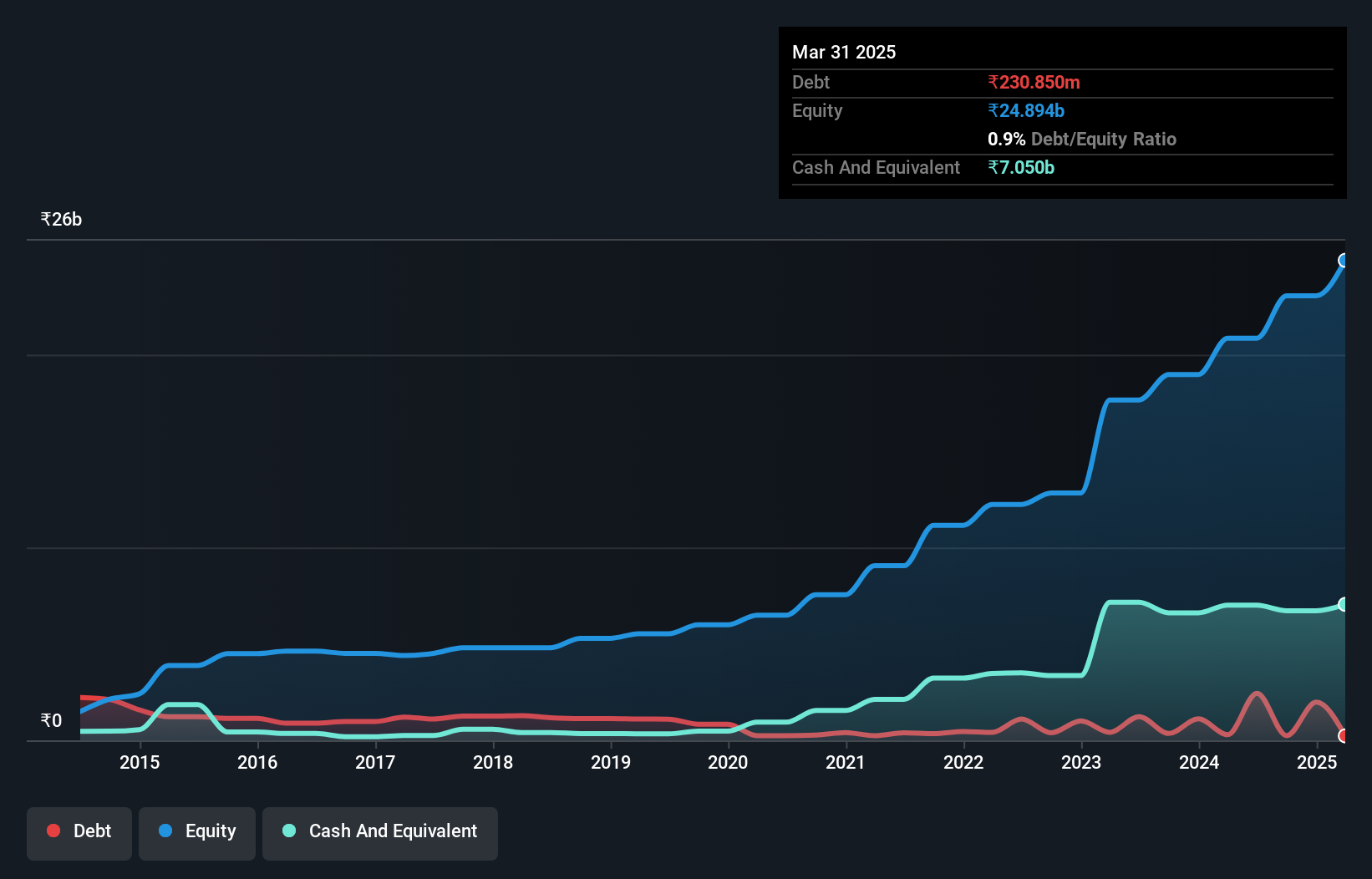

Shriram Pistons & Rings has shown impressive earnings growth of 33.7% over the past year, outpacing the Auto Components industry’s 20.1%. The company’s debt to equity ratio increased from 12.2% to 24.1% in five years, yet it holds more cash than total debt, indicating financial robustness. Trading at a P/E ratio of 22.7x, below the Indian market average of 34.3x, it offers good value relative to peers and industry standards

- Dive into the specifics of Shriram Pistons & Rings here with our thorough health report.

Assess Shriram Pistons & Rings' past performance with our detailed historical performance reports.

Key Takeaways

- Unlock more gems! Our Indian Undiscovered Gems With Strong Fundamentals screener has unearthed 473 more companies for you to explore.Click here to unveil our expertly curated list of 476 Indian Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SHRIPISTON

Shriram Pistons & Rings

Manufactures and sells automotive components in India.

Solid track record with excellent balance sheet.