Over the last 7 days, the Indian market has dropped 1.2%, yet it remains up by an impressive 38% over the past year with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying stocks with strong growth potential and solid fundamentals can be crucial for investors looking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bengal & Assam | 4.48% | 1.53% | 51.11% | ★★★★★★ |

| Wealth First Portfolio Managers | NA | -47.95% | 40.47% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Indo Amines | 82.32% | 17.15% | 19.98% | ★★★★★☆ |

| Master Trust | 37.05% | 27.64% | 41.99% | ★★★★★☆ |

| Kaycee Industries | 17.35% | 19.50% | 34.62% | ★★★★★☆ |

| Lotus Chocolate | 13.51% | 28.07% | -10.66% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| Vasa Denticity | 0.11% | 38.37% | 48.77% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

D. P. Abhushan (NSEI:DPABHUSHAN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: D. P. Abhushan Limited engages in the manufacturing, sale, and trading of gold, diamond, platinum, silver, and other precious metals and ornaments in India with a market cap of ₹36.93 billion.

Operations: The company generates revenue primarily from the Gems & Jewellery segment, amounting to ₹23.74 billion.

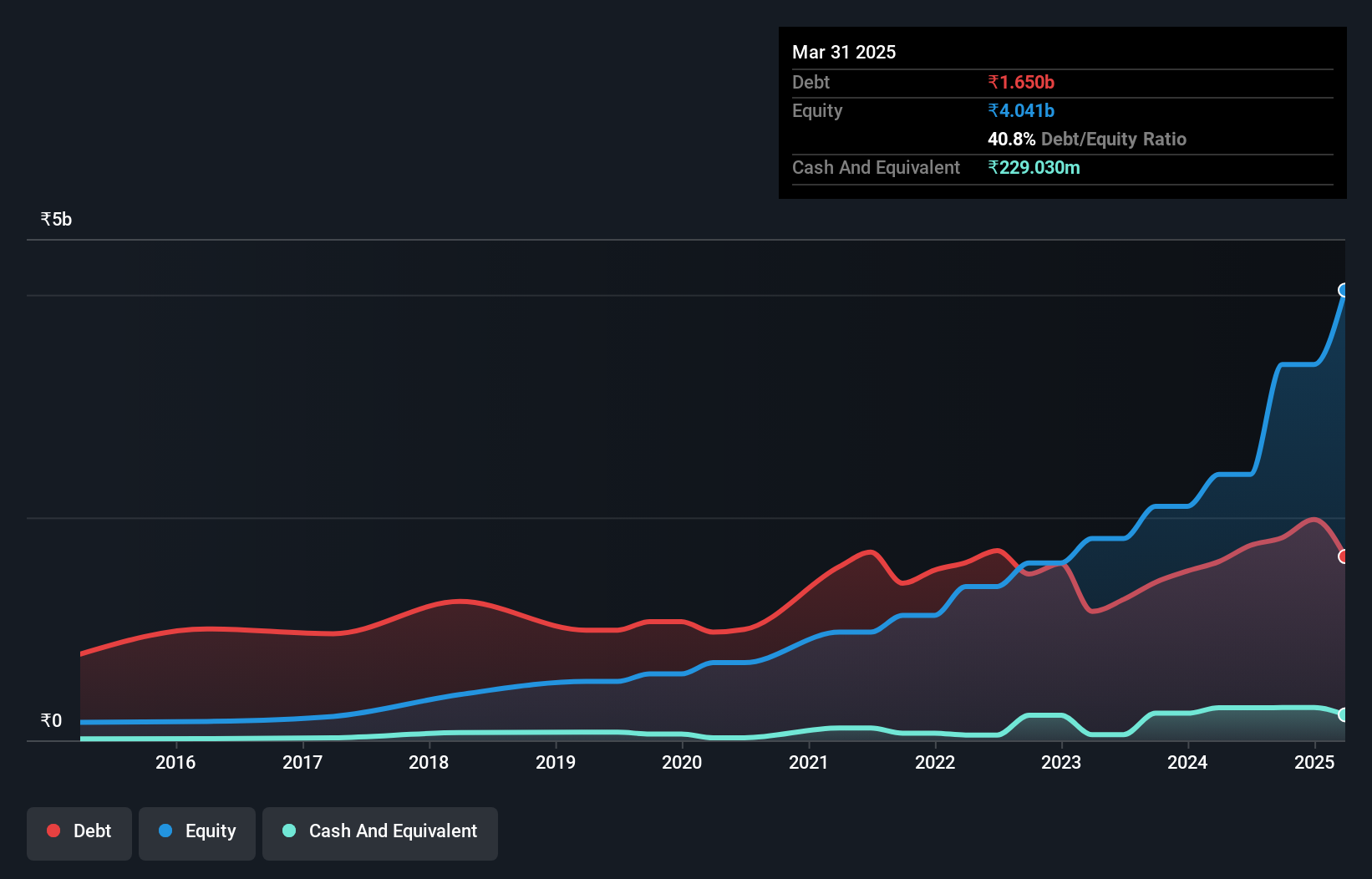

D. P. Abhushan, a notable player in the retail jewellery sector, reported impressive earnings growth of 48.5% over the past year, outpacing the industry average of 23%. The company's debt to equity ratio has significantly improved from 187% to 73.3% over five years, although its net debt to equity remains high at 61%. Recent financials show net income for Q1 2024 at INR 250.77 million, up from INR 156.23 million last year, with basic EPS rising to INR 11.27 from INR 7.02.

- Navigate through the intricacies of D. P. Abhushan with our comprehensive health report here.

Gain insights into D. P. Abhushan's historical performance by reviewing our past performance report.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marksans Pharma Limited, along with its subsidiaries, focuses on the research, manufacturing, marketing, and sale of pharmaceutical formulations across various international markets including the United States, North America, Europe, the United Kingdom, Australia, and New Zealand; it has a market cap of ₹117.08 billion.

Operations: Marksans Pharma generates revenue primarily from its pharmaceutical segment, amounting to ₹22.68 billion. The company's market cap stands at ₹117.08 billion.

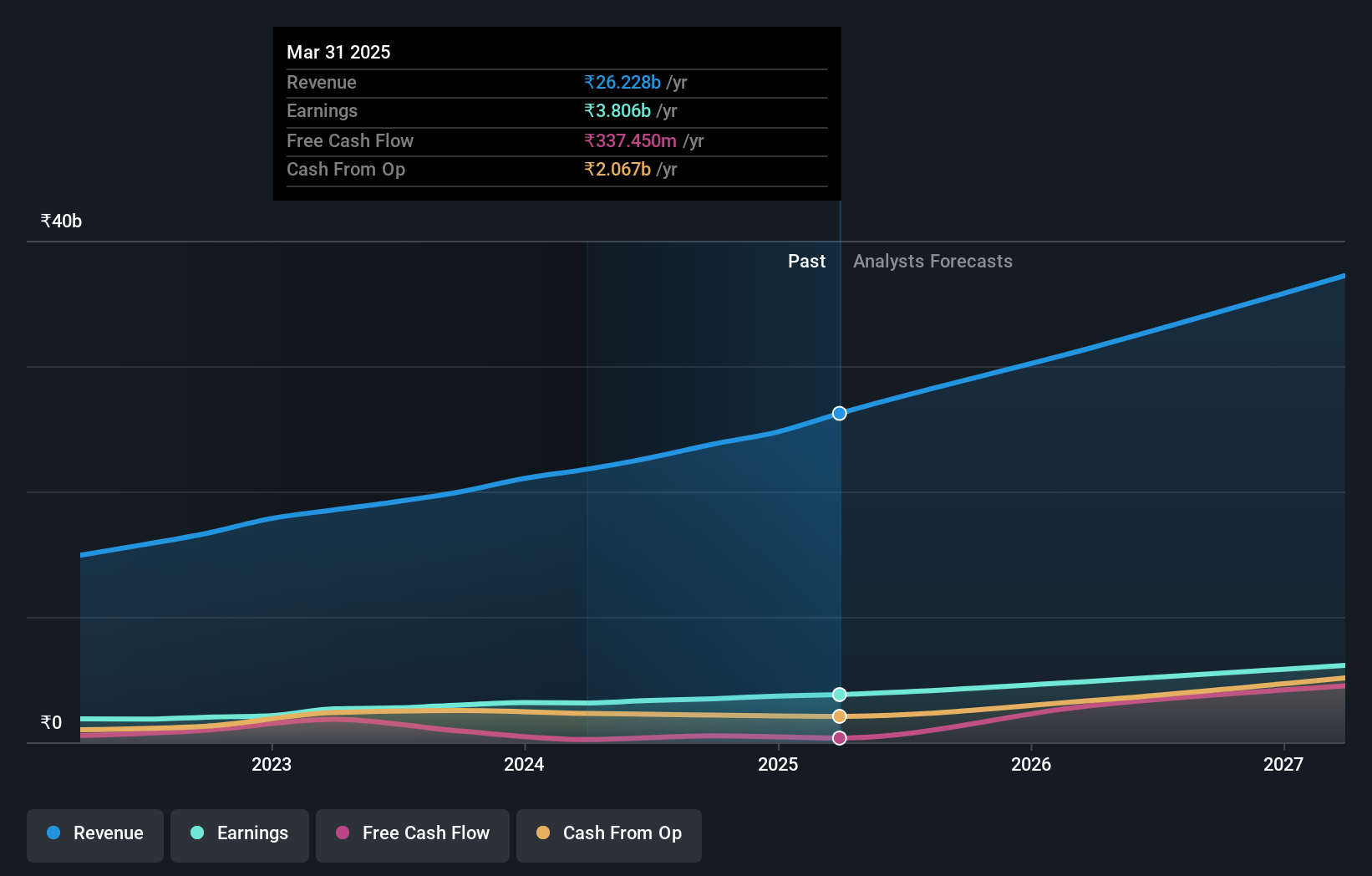

Marksans Pharma, a small cap player in the pharmaceutical sector, has shown impressive financial health with its debt to equity ratio improving from 19.9% to 11.7% over five years and earnings growth of 21.7% last year surpassing industry averages. The company trades at a favorable P/E ratio of 35.1x compared to the industry average of 41.9x, highlighting its value proposition. Recently, Marksans received positive feedback from the USFDA for its Goa facility and is actively exploring M&A opportunities in Europe for further expansion.

- Delve into the full analysis health report here for a deeper understanding of Marksans Pharma.

Explore historical data to track Marksans Pharma's performance over time in our Past section.

Rama Steel Tubes (NSEI:RAMASTEEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Rama Steel Tubes Limited manufactures and trades steel pipes, tubes, and rigid poly vinyl chloride and galvanized iron pipes in India and internationally with a market cap of ₹23.10 billion.

Operations: Rama Steel Tubes Limited generates revenue primarily from manufacturing steel pipes (₹7.16 billion) and trading building materials & steel products (₹2.34 billion). The company has a market cap of ₹23.10 billion.

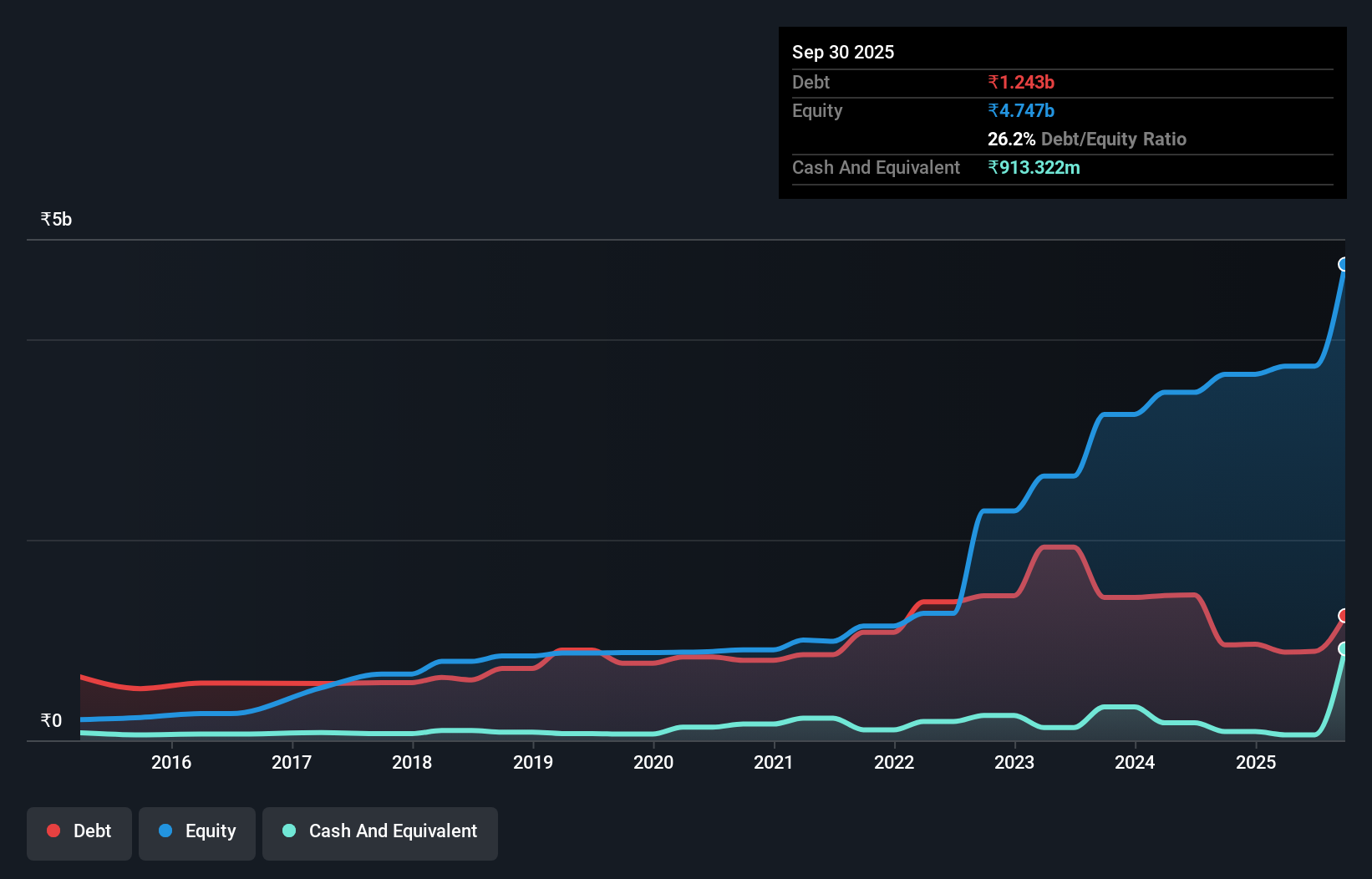

Rama Steel Tubes, a small cap stock, recently reported Q1 2024 earnings with net income of ₹63.57 million on revenue of ₹2.18 billion, reflecting a year-over-year dip. The company’s debt to equity ratio improved significantly from 103.4% to 41.8% over the past five years while maintaining a satisfactory net debt to equity ratio at 36.8%. A strategic collaboration with Onix Renewable Ltd aims to bolster their position in the solar energy sector by providing specialised steel structures and trackers for Greenfield projects, enhancing long-term sustainability and efficiency.

- Dive into the specifics of Rama Steel Tubes here with our thorough health report.

Gain insights into Rama Steel Tubes' past trends and performance with our Past report.

Where To Now?

- Navigate through the entire inventory of 477 Indian Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MARKSANS

Marksans Pharma

Engages in the research, manufacturing, marketing, and sale of pharmaceutical formulations in the United States, North America, Europe, the United Kingdom, Australia, New Zealand, and internationally.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026