The Indian market has stayed flat over the past 7 days but is up 41% over the past year, with earnings expected to grow by 17% annually. In this thriving environment, uncovering hidden gems that show strong potential and align with these growth trends can be particularly rewarding for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bharat Rasayan | 8.15% | 0.10% | -7.93% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.22% | 8.68% | ★★★★★★ |

| AGI Infra | 61.29% | 29.13% | 33.44% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 46.55% | 46.96% | ★★★★★★ |

| TCPL Packaging | 95.84% | 15.51% | 31.89% | ★★★★★☆ |

| Kalyani Investment | NA | 21.42% | 6.35% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.41% | 6.65% | 13.60% | ★★★★☆☆ |

| Sky Gold | 127.01% | 22.02% | 48.03% | ★★★★☆☆ |

| Apollo Micro Systems | 38.51% | 10.59% | 11.93% | ★★★★☆☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Gallantt Ispat (NSEI:GALLANTT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gallantt Ispat Limited engages in the manufacture of iron and steel in India and internationally, with a market cap of ₹86.89 billion.

Operations: Gallantt Ispat generates revenue primarily from the manufacture of iron and steel products. The company has a market cap of ₹86.89 billion.

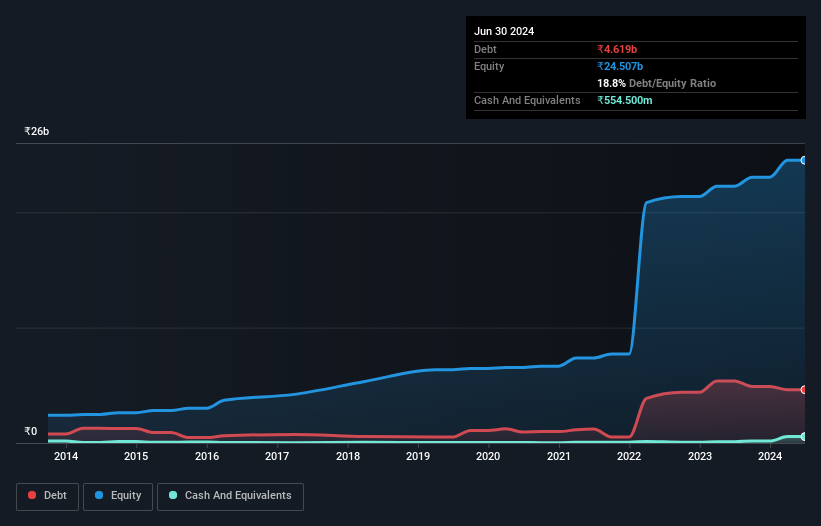

Gallantt Ispat, a promising player in India's metals sector, reported impressive Q1 2024 earnings with net income at INR 1.22 billion, up from INR 307.19 million last year. The P/E ratio stands at 27.5x, below the Indian market average of 33x, indicating good value. Their net debt to equity ratio is satisfactory at 16.6%, and interest payments are well-covered by EBIT (16.8x). Earnings surged by 115% over the past year, outpacing industry growth of nearly 16%.

- Unlock comprehensive insights into our analysis of Gallantt Ispat stock in this health report.

Examine Gallantt Ispat's past performance report to understand how it has performed in the past.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marksans Pharma Limited, along with its subsidiaries, focuses on the research and development, manufacturing, marketing, and sale of generic pharmaceutical formulations globally and has a market cap of ₹97.13 billion.

Operations: Marksans Pharma derives its revenue primarily from the sale of generic pharmaceutical formulations. The company has a market cap of ₹97.13 billion and operates globally through its subsidiaries.

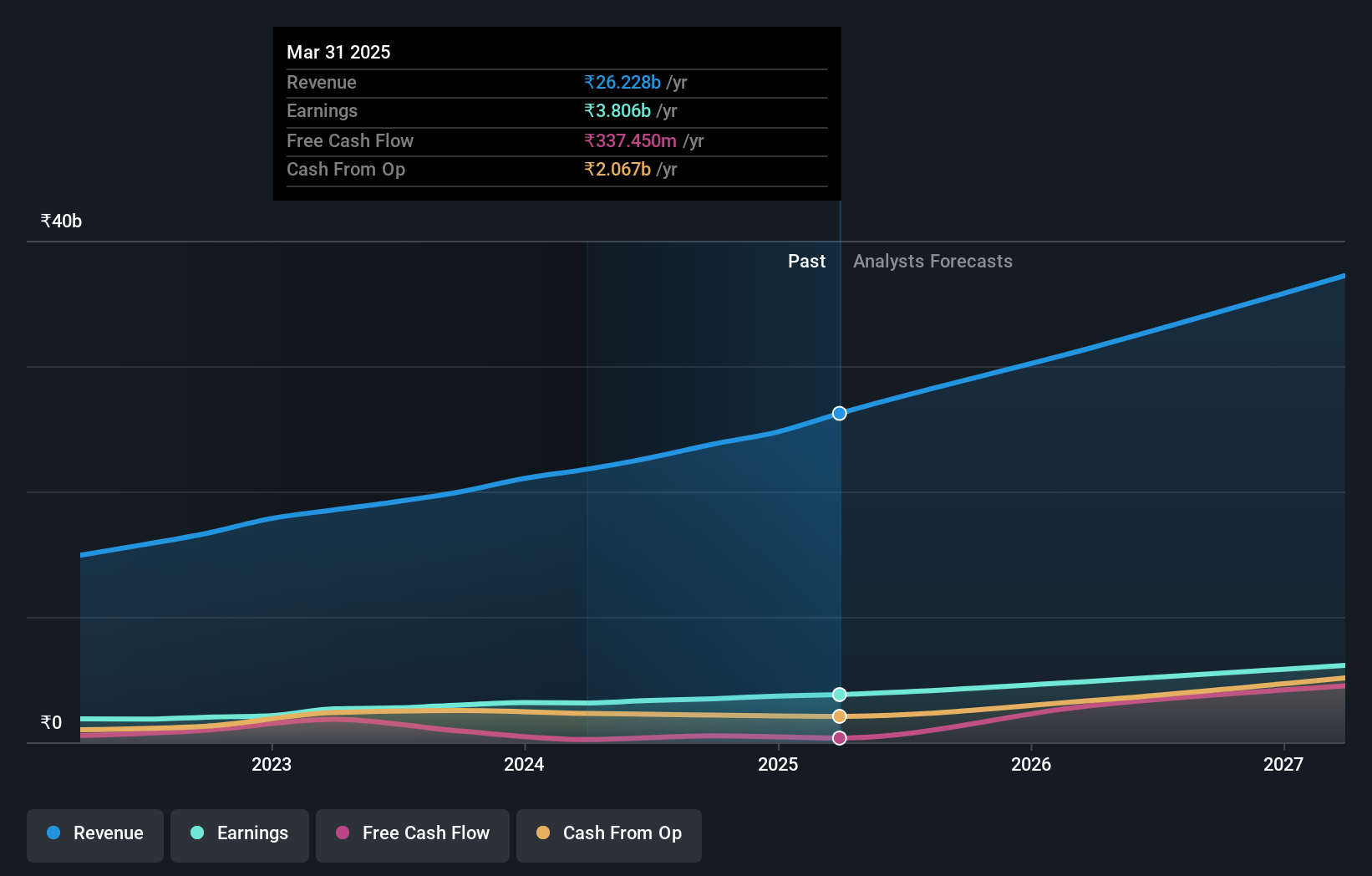

Marksans Pharma has shown impressive growth, with earnings up 21.7% over the past year, surpassing industry averages. The company's debt to equity ratio improved from 19.9% to 11.7% in five years, and its EBIT covers interest payments by a robust 32.2 times. Trading at a P/E ratio of 29.1x, it's cheaper than the Indian market average of 33x. Recent quarterly results reported sales of ₹5,906 million and net income of ₹887 million, reflecting solid performance momentum.

- Click here and access our complete health analysis report to understand the dynamics of Marksans Pharma.

Gain insights into Marksans Pharma's past trends and performance with our Past report.

Time Technoplast (NSEI:TIMETECHNO)

Simply Wall St Value Rating: ★★★★★★

Overview: Time Technoplast Limited, along with its subsidiaries, manufactures and sells a variety of technology-based polymer and composite products in India and internationally, with a market cap of ₹86.77 billion.

Operations: Time Technoplast generates revenue primarily through the sale of technology-based polymer and composite products. The company's net profit margin stands at 5.04%, reflecting its profitability after accounting for all expenses.

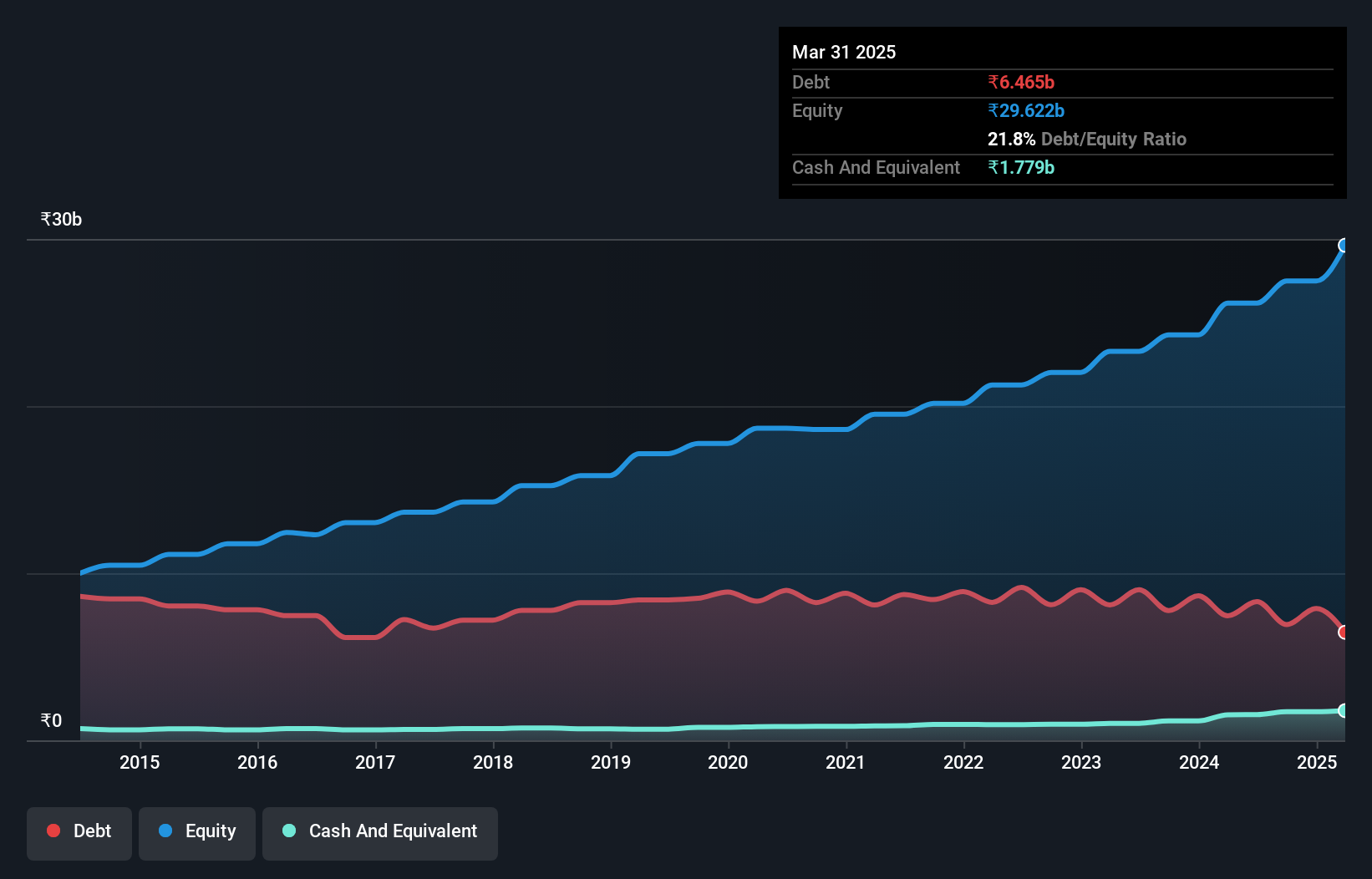

Time Technoplast has shown impressive earnings growth of 44.6% over the past year, outpacing the Packaging industry’s 3.3%. The company’s net debt to equity ratio stands at a satisfactory 25.9%, down from 49% five years ago, indicating improved financial health. Recent earnings for Q1 2025 reported sales of INR 12,300.5 million and net income of INR 793.1 million, with basic EPS rising to INR 3.49 from INR 2.48 a year earlier.

Seize The Opportunity

- Unlock more gems! Our Indian Undiscovered Gems With Strong Fundamentals screener has unearthed 447 more companies for you to explore.Click here to unveil our expertly curated list of 450 Indian Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Time Technoplast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TIMETECHNO

Time Technoplast

Engages in manufacture and sale of polymer and composite products in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives