Investor Optimism Abounds Lupin Limited (NSE:LUPIN) But Growth Is Lacking

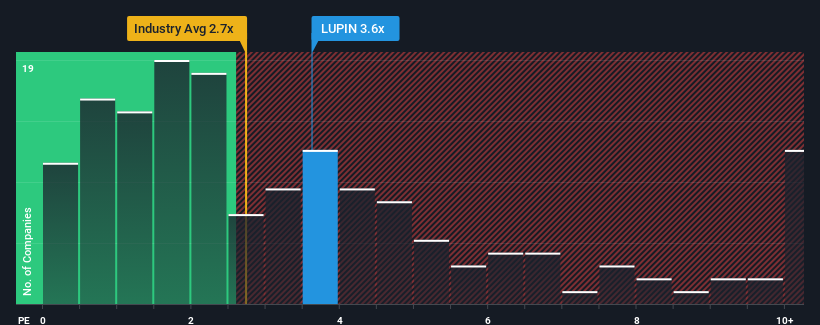

When you see that almost half of the companies in the Pharmaceuticals industry in India have price-to-sales ratios (or "P/S") below 2.7x, Lupin Limited (NSE:LUPIN) looks to be giving off some sell signals with its 3.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Lupin

What Does Lupin's P/S Mean For Shareholders?

Recent times have been advantageous for Lupin as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Lupin.Is There Enough Revenue Growth Forecasted For Lupin?

The only time you'd be truly comfortable seeing a P/S as high as Lupin's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. As a result, it also grew revenue by 28% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 11% each year over the next three years. With the industry predicted to deliver 10% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's curious that Lupin's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Lupin's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Analysts are forecasting Lupin's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Lupin with six simple checks.

If these risks are making you reconsider your opinion on Lupin, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LUPIN

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives