Laurus Labs' (NSE:LAURUSLABS) five-year total shareholder returns outpace the underlying earnings growth

Long term investing can be life changing when you buy and hold the truly great businesses. While the best companies are hard to find, but they can generate massive returns over long periods. Just think about the savvy investors who held Laurus Labs Limited (NSE:LAURUSLABS) shares for the last five years, while they gained 307%. This just goes to show the value creation that some businesses can achieve. On top of that, the share price is up 40% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

In light of the stock dropping 3.2% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

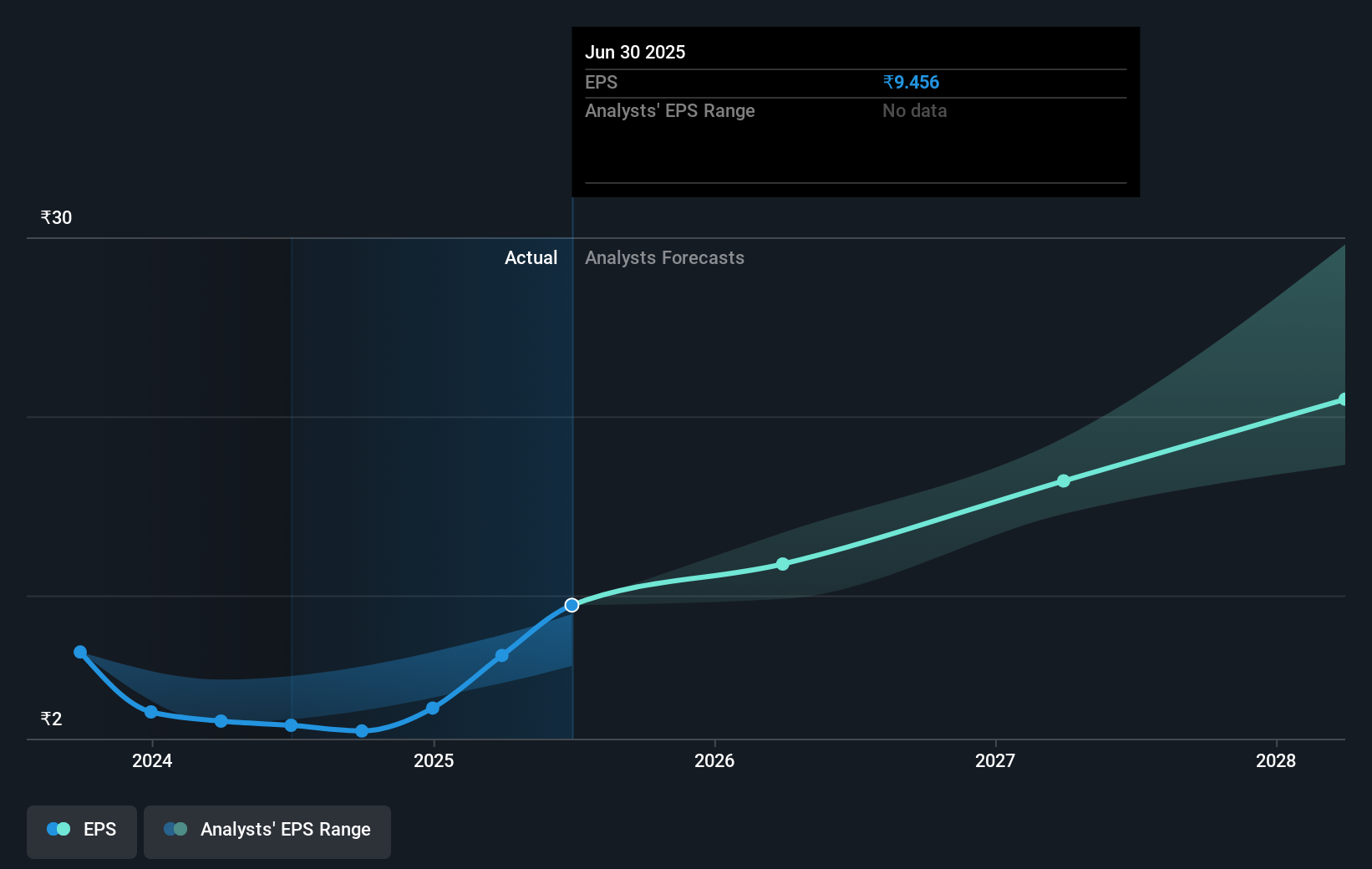

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Laurus Labs managed to grow its earnings per share at 4.1% a year. This EPS growth is slower than the share price growth of 32% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 87.19.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Laurus Labs has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Laurus Labs, it has a TSR of 315% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Laurus Labs has rewarded shareholders with a total shareholder return of 93% in the last twelve months. Of course, that includes the dividend. That's better than the annualised return of 33% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Laurus Labs better, we need to consider many other factors. For example, we've discovered 1 warning sign for Laurus Labs that you should be aware of before investing here.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LAURUSLABS

Laurus Labs

Manufactures and sells medicines and active pharmaceutical ingredients (APIs) in India and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives