Laurus Labs Limited's (NSE:LAURUSLABS) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Laurus Labs (NSE:LAURUSLABS) has had a great run on the share market with its stock up by a significant 16% over the last month. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. In this article, we decided to focus on Laurus Labs' ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Laurus Labs

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Laurus Labs is:

3.2% = ₹1.3b ÷ ₹41b (Based on the trailing twelve months to September 2024).

The 'return' is the income the business earned over the last year. That means that for every ₹1 worth of shareholders' equity, the company generated ₹0.03 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Laurus Labs' Earnings Growth And 3.2% ROE

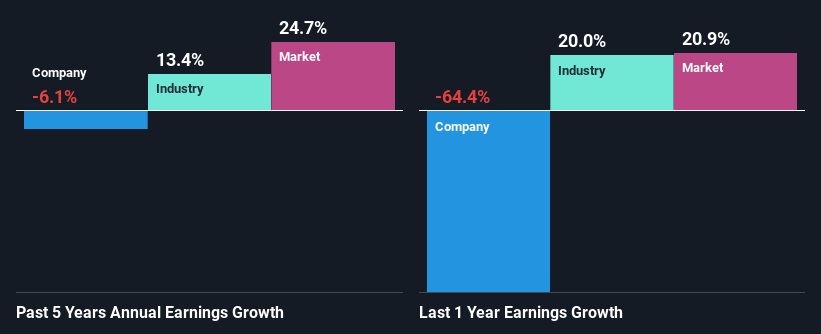

It is hard to argue that Laurus Labs' ROE is much good in and of itself. Even when compared to the industry average of 12%, the ROE figure is pretty disappointing. Given the circumstances, the significant decline in net income by 6.1% seen by Laurus Labs over the last five years is not surprising. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

However, when we compared Laurus Labs' growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 13% in the same period. This is quite worrisome.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Laurus Labs''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Laurus Labs Efficiently Re-investing Its Profits?

Laurus Labs' low three-year median payout ratio of 13% (implying that it retains the remaining 87% of its profits) comes as a surprise when you pair it with the shrinking earnings. The low payout should mean that the company is retaining most of its earnings and consequently, should see some growth. So there might be other factors at play here which could potentially be hampering growth. For instance, the business has faced some headwinds.

In addition, Laurus Labs has been paying dividends over a period of eight years suggesting that keeping up dividend payments is preferred by the management even though earnings have been in decline. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 13%. However, Laurus Labs' ROE is predicted to rise to 13% despite there being no anticipated change in its payout ratio.

Conclusion

Overall, we have mixed feelings about Laurus Labs. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LAURUSLABS

Laurus Labs

Manufactures and sells medicines and active pharmaceutical ingredients (APIs) in India and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)