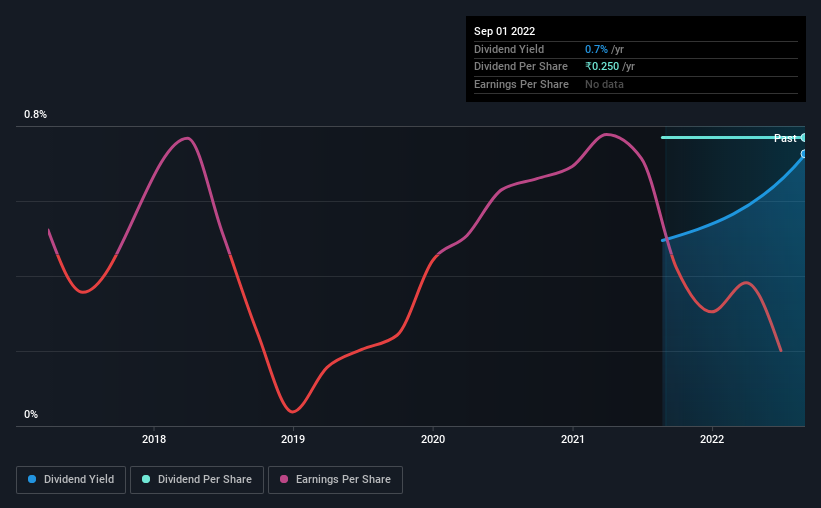

Lasa Supergenerics Limited (NSE:LASA) has announced that it will pay a dividend of ₹0.25 per share on the 26th of October. This payment means the dividend yield will be 0.7%, which is below the average for the industry.

See our latest analysis for Lasa Supergenerics

Lasa Supergenerics Might Find It Hard To Continue The Dividend

If it is predictable over a long period, even low dividend yields can be attractive. While Lasa Supergenerics is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Assuming the trend of the last few years continues, EPS will grow by 12.3% over the next 12 months. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. However, the positive cash flow ratio gives us some comfort about the sustainability of the dividend.

Lasa Supergenerics Is Still Building Its Track Record

Without a track record of dividend payments, we can't make a judgement on how stable it has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Company Could Face Some Challenges Growing The Dividend

Investors could be attracted to the stock based on the quality of its payment history. It's encouraging to see that Lasa Supergenerics has been growing its earnings per share at 12% a year over the past five years. Even though the company isn't making a profit, strong earnings growth could turn that around in the near future. Assuming the company can post positive net income numbers soon, it could has the potential to be a decent dividend payer.

Our Thoughts On Lasa Supergenerics' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, Lasa Supergenerics has 3 warning signs (and 1 which is significant) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LASA

Lasa Supergenerics

Engages in the research, manufacture, and marketing of animal and human healthcare products in India.

Excellent balance sheet low.

Market Insights

Community Narratives