- India

- /

- Healthcare Services

- /

- NSEI:JSLL

Should You Be Adding Jeena Sikho Lifecare (NSE:JSLL) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Jeena Sikho Lifecare (NSE:JSLL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Jeena Sikho Lifecare

How Fast Is Jeena Sikho Lifecare Growing Its Earnings Per Share?

Over the last three years, Jeena Sikho Lifecare has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, Jeena Sikho Lifecare's EPS grew from ₹6.17 to ₹13.59, over the previous 12 months. It's not often a company can achieve year-on-year growth of 120%. That could be a sign that the business has reached a true inflection point.

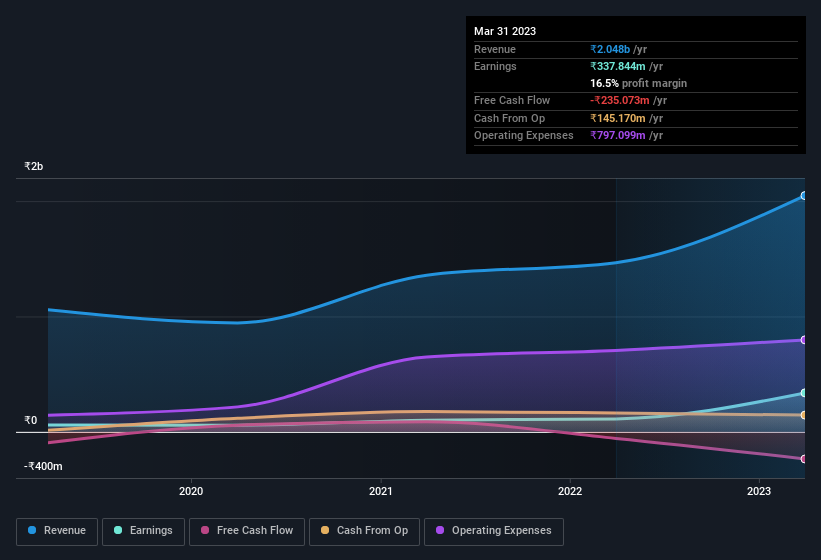

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Jeena Sikho Lifecare shareholders is that EBIT margins have grown from 10% to 21% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Jeena Sikho Lifecare isn't a huge company, given its market capitalisation of ₹22b. That makes it extra important to check on its balance sheet strength.

Are Jeena Sikho Lifecare Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We do note that, in the last year, insiders sold ₹6.8m worth of shares. But that's far less than the ₹120m insiders spent purchasing stock. This bodes well for Jeena Sikho Lifecare as it highlights the fact that those who are important to the company having a lot of faith in its future. It is also worth noting that it was Chairman & MD Manish Grover who made the biggest single purchase, worth ₹27m, paying ₹266 per share.

On top of the insider buying, we can also see that Jeena Sikho Lifecare insiders own a large chunk of the company. To be exact, company insiders hold 71% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at ₹16b at the current share price. So there's plenty there to keep them focused!

Should You Add Jeena Sikho Lifecare To Your Watchlist?

Jeena Sikho Lifecare's earnings per share have been soaring, with growth rates sky high. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Jeena Sikho Lifecare deserves timely attention. Before you take the next step you should know about the 2 warning signs for Jeena Sikho Lifecare (1 is concerning!) that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, Jeena Sikho Lifecare isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JSLL

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026