Does Jagsonpal Pharmaceuticals (NSE:JAGSNPHARM) Deserve A Spot On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Jagsonpal Pharmaceuticals (NSE:JAGSNPHARM). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Jagsonpal Pharmaceuticals

How Fast Is Jagsonpal Pharmaceuticals Growing Its Earnings Per Share?

In the last three years Jagsonpal Pharmaceuticals's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Jagsonpal Pharmaceuticals's EPS shot from ₹3.00 to ₹6.51, over the last year. Year on year growth of 117% is certainly a sight to behold.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Jagsonpal Pharmaceuticals shareholders can take confidence from the fact that EBIT margins are up from 4.7% to 9.6%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

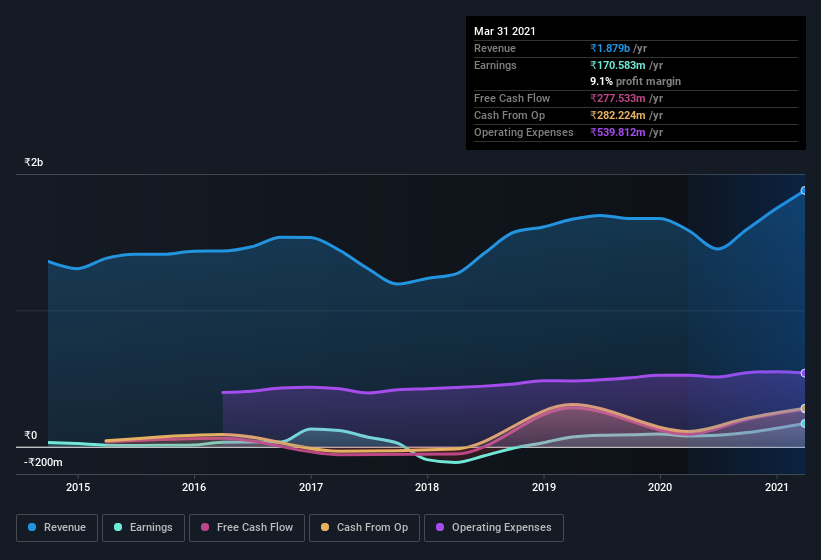

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Jagsonpal Pharmaceuticals isn't a huge company, given its market capitalization of ₹3.8b. That makes it extra important to check on its balance sheet strength.

Are Jagsonpal Pharmaceuticals Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Jagsonpal Pharmaceuticals insiders refrain from selling stock during the year, but they also spent ₹9.5m buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident. We also note that it was the Vice President of International Business and International Marketing, Prithipal Kochhar, who made the biggest single acquisition, paying ₹2.0m for shares at about ₹63.94 each.

Should You Add Jagsonpal Pharmaceuticals To Your Watchlist?

Jagsonpal Pharmaceuticals's earnings per share have taken off like a rocket aimed right at the moon. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And indeed, it could be a sign that the business is at an inflection point. If that's the case, you may regret neglecting to put Jagsonpal Pharmaceuticals on your watchlist. We should say that we've discovered 3 warning signs for Jagsonpal Pharmaceuticals that you should be aware of before investing here.

The good news is that Jagsonpal Pharmaceuticals is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Jagsonpal Pharmaceuticals or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:JAGSNPHARM

Jagsonpal Pharmaceuticals

Engages in the manufacturing, selling, and trading of pharmaceutical products and active pharmaceutical ingredients in India and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives