Ipca Laboratories' (NSE:IPCALAB) 20% CAGR outpaced the company's earnings growth over the same three-year period

One simple way to benefit from the stock market is to buy an index fund. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, the Ipca Laboratories Limited (NSE:IPCALAB) share price is up 71% in the last three years, clearly besting the market return of around 53% (not including dividends).

Since the stock has added ₹41b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

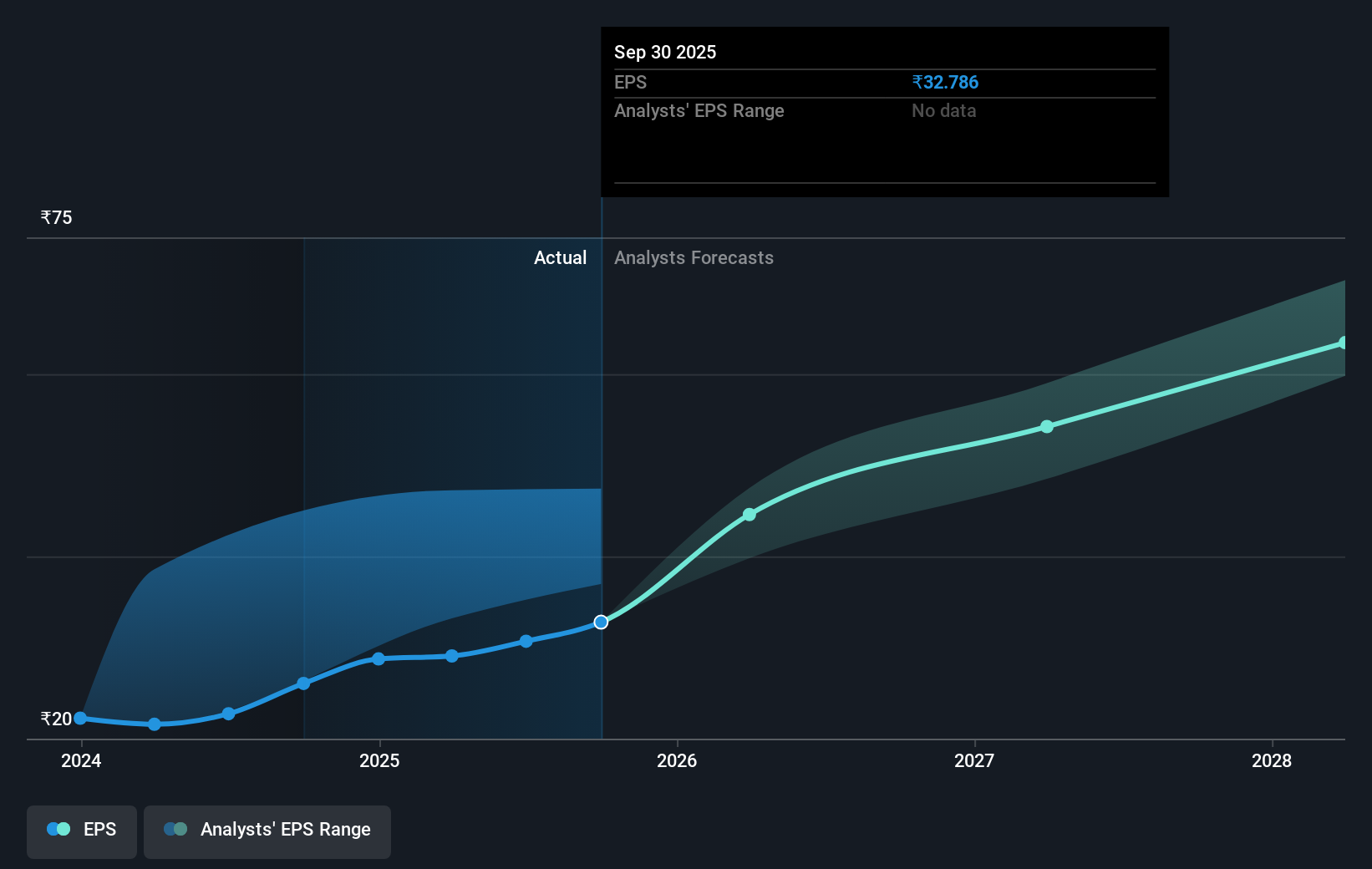

Ipca Laboratories was able to grow its EPS at 11% per year over three years, sending the share price higher. In comparison, the 20% per year gain in the share price outpaces the EPS growth. This indicates that the market is feeling more optimistic on the stock, after the last few years of progress. It is quite common to see investors become enamoured with a business, after a few years of solid progress. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 45.13.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Ipca Laboratories has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

Ipca Laboratories shareholders are down 3.4% for the year (even including dividends), but the market itself is up 7.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 7% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before forming an opinion on Ipca Laboratories you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IPCALAB

Ipca Laboratories

An integrated pharmaceutical company, manufactures and markets formulations and active pharmaceutical ingredients (APIs) for various therapeutic segments in India, Europe, Africa, the Americas, Asia, the Commonwealth of Independent States, and Australasia.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives