Indoco Remedies (NSE:INDOCO) Has Announced That It Will Be Increasing Its Dividend To ₹1.50

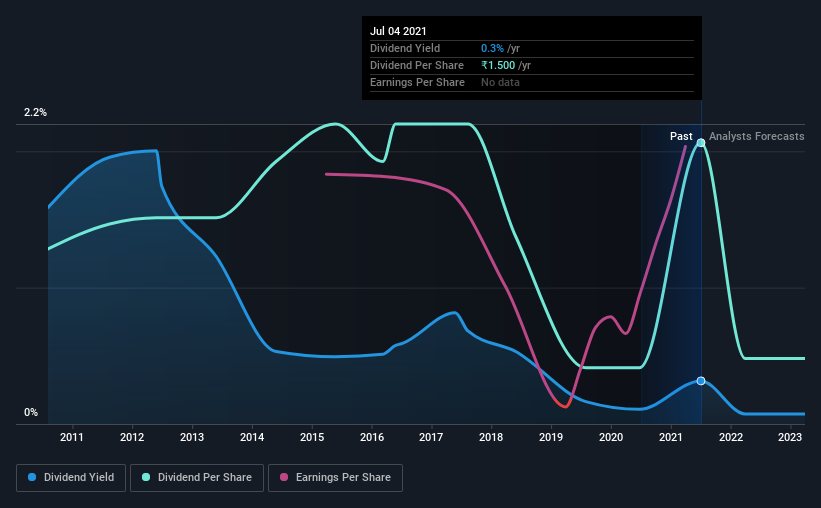

Indoco Remedies Limited (NSE:INDOCO) has announced that it will be increasing its dividend on the 23rd of October to ₹1.50. Even though the dividend went up, the yield is still quite low at only 0.3%.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Indoco Remedies' stock price has increased by 66% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

See our latest analysis for Indoco Remedies

Indoco Remedies' Payment Has Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. Based on the last payment, Indoco Remedies was paying only paying out a fraction of earnings, but the payment was a massive 257% of cash flows. While the business may be attempting to set a balanced dividend policy, a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

The next year is set to see EPS grow by 40.3%. If the dividend continues along recent trends, we estimate the payout ratio will be 9.2%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2011, the first annual payment was ₹0.93, compared to the most recent full-year payment of ₹1.50. This means that it has been growing its distributions at 4.9% per annum over that time. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

The Dividend's Growth Prospects Are Limited

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings have grown at around 2.6% a year for the past five years, which isn't massive but still better than seeing them shrink. While growth may be thin on the ground, Indoco Remedies could always pay out a higher proportion of earnings to increase shareholder returns.

Our Thoughts On Indoco Remedies' Dividend

Overall, we always like to see the dividend being raised, but we don't think Indoco Remedies will make a great income stock. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. We don't think Indoco Remedies is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 1 warning sign for Indoco Remedies that investors need to be conscious of moving forward. We have also put together a list of global stocks with a solid dividend.

When trading Indoco Remedies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:INDOCO

Indoco Remedies

Manufactures and markets formulations and active pharmaceutical ingredients in India and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026