Here's What Gufic Biosciences Limited's (NSE:GUFICBIO) Shareholder Ownership Structure Looks Like

Every investor in Gufic Biosciences Limited (NSE:GUFICBIO) should be aware of the most powerful shareholder groups. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

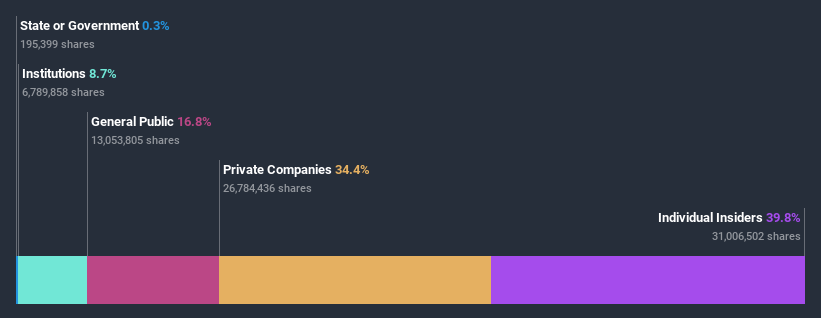

Gufic Biosciences is not a large company by global standards. It has a market capitalization of ₹9.1b, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutions are noticeable on the share registry. Let's take a closer look to see what the different types of shareholders can tell us about Gufic Biosciences.

Check out our latest analysis for Gufic Biosciences

What Does The Institutional Ownership Tell Us About Gufic Biosciences?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

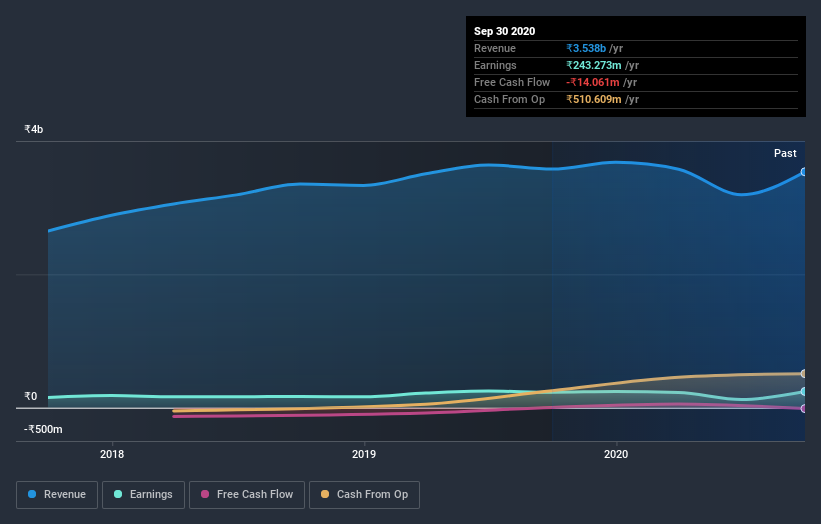

We can see that Gufic Biosciences does have institutional investors; and they hold a good portion of the company's stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Gufic Biosciences' earnings history below. Of course, the future is what really matters.

Hedge funds don't have many shares in Gufic Biosciences. The company's largest shareholder is Zircon Teconica Private Limited, with ownership of 26%. Jayesh Choksi is the second largest shareholder owning 23% of common stock, and Pranav Choksi holds about 9.3% of the company stock. Interestingly, the bottom two of the top three shareholders also hold the title of Top Key Executive and Member of the Board of Directors, respectively, suggesting that these insiders have a personal stake in the company.

To make our study more interesting, we found that the top 3 shareholders have a majority ownership in the company, meaning that they are powerful enough to influence the decisions of the company.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Gufic Biosciences

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own a reasonable proportion of Gufic Biosciences Limited. Insiders have a ₹3.6b stake in this ₹9.1b business. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public holds a 17% stake in Gufic Biosciences. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

It seems that Private Companies own 34%, of the Gufic Biosciences stock. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Gufic Biosciences you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading Gufic Biosciences or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:GUFICBIO

Gufic Biosciences

Manufactures and markets active pharmaceutical ingredients (APIs), generic pharmaceuticals, and related services in India, Africa, Asia, Europe, Australia, North America, South America, and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives