Earnings Tell The Story For Gufic Biosciences Limited (NSE:GUFICBIO)

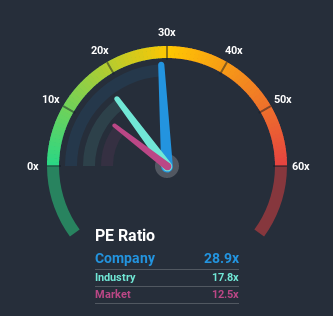

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 12x, you may consider Gufic Biosciences Limited (NSE:GUFICBIO) as a stock to avoid entirely with its 28.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Gufic Biosciences certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Gufic Biosciences

Is There Enough Growth For Gufic Biosciences?

The only time you'd be truly comfortable seeing a P/E as steep as Gufic Biosciences' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 48% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 131% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is predicted to shrink 6.5% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

In light of this, it's understandable that Gufic Biosciences' P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse. Nonetheless, with most other businesses facing an uphill battle, staying on its current earnings path is no certainty.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Gufic Biosciences revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Our only concern is whether its earnings trajectory can keep outperforming under these tough market conditions. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

Having said that, be aware Gufic Biosciences is showing 3 warning signs in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

If you’re looking to trade Gufic Biosciences, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:GUFICBIO

Gufic Biosciences

Manufactures and markets active pharmaceutical ingredients (APIs), generic pharmaceuticals, and related services in India, Africa, Asia, Europe, Australia, North America, South America, and internationally.

Excellent balance sheet with questionable track record.