- India

- /

- Life Sciences

- /

- NSEI:DCAL

Dishman Carbogen Amcis Limited (NSE:DCAL) Shares Fly 28% But Investors Aren't Buying For Growth

Dishman Carbogen Amcis Limited (NSE:DCAL) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 52% in the last year.

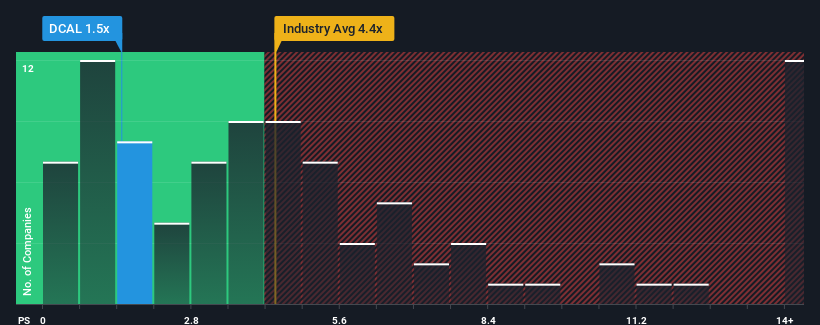

In spite of the firm bounce in price, considering about half the companies operating in India's Life Sciences industry have price-to-sales ratios (or "P/S") above 5.1x, you may still consider Dishman Carbogen Amcis as an great investment opportunity with its 1.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Dishman Carbogen Amcis

What Does Dishman Carbogen Amcis' Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Dishman Carbogen Amcis' revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. Those who are bullish on Dishman Carbogen Amcis will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Dishman Carbogen Amcis will help you shine a light on its historical performance.How Is Dishman Carbogen Amcis' Revenue Growth Trending?

Dishman Carbogen Amcis' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 30% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 17% shows it's noticeably less attractive.

In light of this, it's understandable that Dishman Carbogen Amcis' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Final Word

Dishman Carbogen Amcis' recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Dishman Carbogen Amcis revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Dishman Carbogen Amcis (of which 1 is potentially serious!) you should know about.

If these risks are making you reconsider your opinion on Dishman Carbogen Amcis, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DCAL

Dishman Carbogen Amcis

Provides contract research and manufacturing services for the pharmaceutical, healthcare, and bio-technology industries worldwide.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives