Investing in stocks inevitably means buying into some companies that perform poorly. But long term Dishman Carbogen Amcis Limited (NSE:DCAL) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 65% share price collapse, in that time. Shareholders have had an even rougher run lately, with the share price down 16% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

View our latest analysis for Dishman Carbogen Amcis

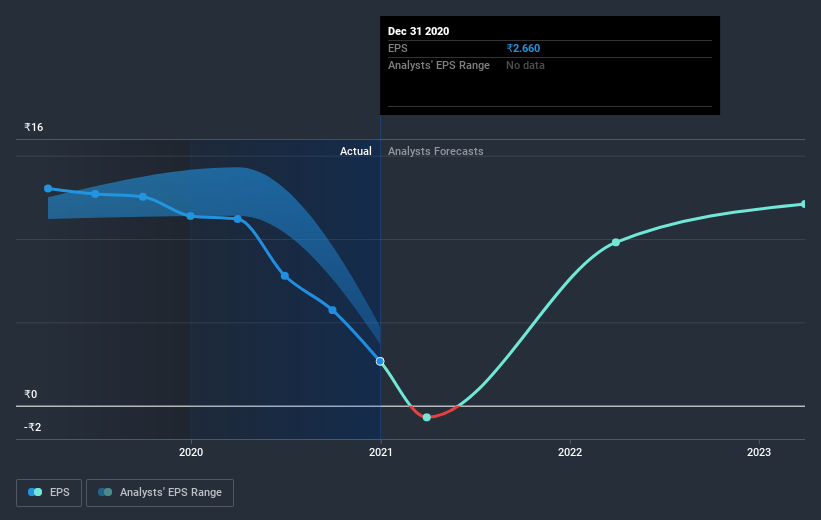

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Dishman Carbogen Amcis saw its EPS decline at a compound rate of 35% per year, over the last three years. This change in EPS is reasonably close to the 29% average annual decrease in the share price. So it seems like sentiment towards the stock hasn't changed all that much over time. In this case, it seems that the EPS is guiding the share price.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's nice to see that Dishman Carbogen Amcis shareholders have gained 43% (in total) over the last year. This recent result is much better than the 18% drop suffered by shareholders each year (on average) over the last three. It could well be that the business has turned around -- or else regained the confidence of investors. It's always interesting to track share price performance over the longer term. But to understand Dishman Carbogen Amcis better, we need to consider many other factors. For instance, we've identified 3 warning signs for Dishman Carbogen Amcis that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Dishman Carbogen Amcis, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:DCAL

Dishman Carbogen Amcis

Provides contract research and manufacturing services for the pharmaceutical and healthcare industries worldwide.

Questionable track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives