Does Caplin Point Laboratories (NSE:CAPLIPOINT) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Caplin Point Laboratories (NSE:CAPLIPOINT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Caplin Point Laboratories with the means to add long-term value to shareholders.

View our latest analysis for Caplin Point Laboratories

How Fast Is Caplin Point Laboratories Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that Caplin Point Laboratories has managed to grow EPS by 25% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

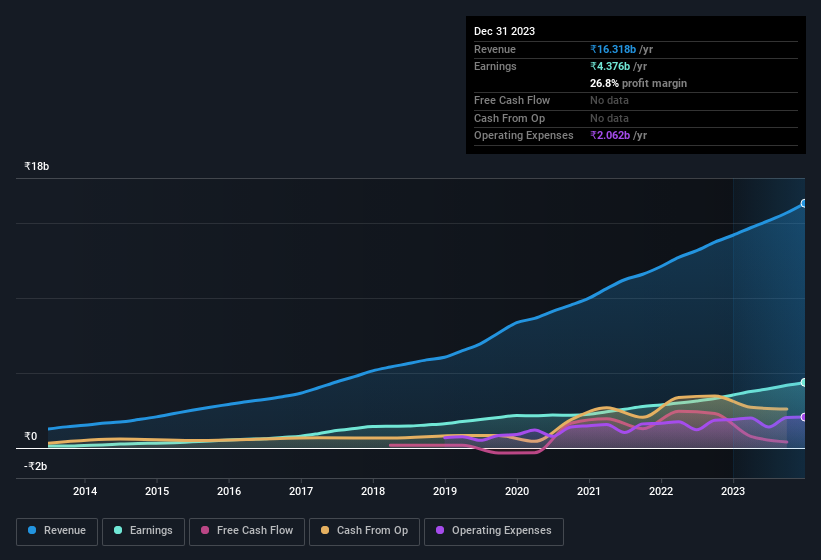

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Caplin Point Laboratories shareholders can take confidence from the fact that EBIT margins are up from 26% to 30%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Caplin Point Laboratories Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Caplin Point Laboratories insiders own a significant number of shares certainly is appealing. To be exact, company insiders hold 70% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a staggering ₹69b. This is an incredible endorsement from them.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to Caplin Point Laboratories, with market caps between ₹33b and ₹133b, is around ₹31m.

The CEO of Caplin Point Laboratories only received ₹8.7m in total compensation for the year ending March 2023. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Caplin Point Laboratories Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Caplin Point Laboratories' strong EPS growth. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. The overarching message here is that Caplin Point Laboratories has underlying strengths that make it worth a look at. You still need to take note of risks, for example - Caplin Point Laboratories has 1 warning sign we think you should be aware of.

Although Caplin Point Laboratories certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Indian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CAPLIPOINT

Caplin Point Laboratories

Engages in the development, production, marketing, and export of generic formulations and branded products in India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives