Biofil Chemicals and Pharmaceuticals Limited's (NSE:BIOFILCHEM) Shares Climb 60% But Its Business Is Yet to Catch Up

Despite an already strong run, Biofil Chemicals and Pharmaceuticals Limited (NSE:BIOFILCHEM) shares have been powering on, with a gain of 60% in the last thirty days. The last 30 days were the cherry on top of the stock's 1,032% gain in the last year, which is nothing short of spectacular.

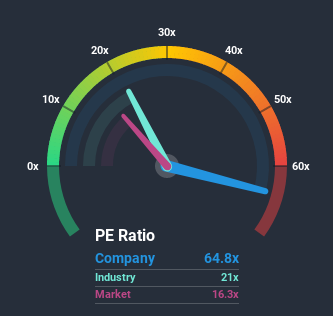

Since its price has surged higher, Biofil Chemicals and Pharmaceuticals' price-to-earnings (or "P/E") ratio of 64.8x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 16x and even P/E's below 8x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Biofil Chemicals and Pharmaceuticals certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Biofil Chemicals and Pharmaceuticals

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Biofil Chemicals and Pharmaceuticals' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 148%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 23% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 11% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Biofil Chemicals and Pharmaceuticals is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Biofil Chemicals and Pharmaceuticals' P/E

Biofil Chemicals and Pharmaceuticals' P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Biofil Chemicals and Pharmaceuticals currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Biofil Chemicals and Pharmaceuticals you should know about.

You might be able to find a better investment than Biofil Chemicals and Pharmaceuticals. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

When trading Biofil Chemicals and Pharmaceuticals or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Biofil Chemicals and Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:BIOFILCHEM

Biofil Chemicals and Pharmaceuticals

Manufactures and trades in pharmaceuticals in India.

Flawless balance sheet low.

Market Insights

Community Narratives