Earnings Tell The Story For Beta Drugs Limited (NSE:BETA) As Its Stock Soars 29%

Beta Drugs Limited (NSE:BETA) shares have continued their recent momentum with a 29% gain in the last month alone. The annual gain comes to 124% following the latest surge, making investors sit up and take notice.

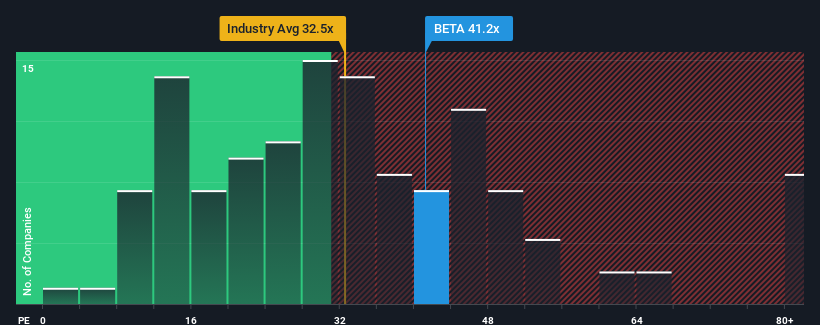

After such a large jump in price, Beta Drugs may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 41.2x, since almost half of all companies in India have P/E ratios under 29x and even P/E's lower than 16x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Beta Drugs has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Beta Drugs

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Beta Drugs' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 20%. The latest three year period has also seen an excellent 267% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 26% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Beta Drugs is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

What We Can Learn From Beta Drugs' P/E?

Beta Drugs' P/E is getting right up there since its shares have risen strongly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Beta Drugs maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Beta Drugs with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than Beta Drugs. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Beta Drugs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BETA

Flawless balance sheet with acceptable track record.