Zee Entertainment Enterprises Limited's (NSE:ZEEL) Business Is Yet to Catch Up With Its Share Price

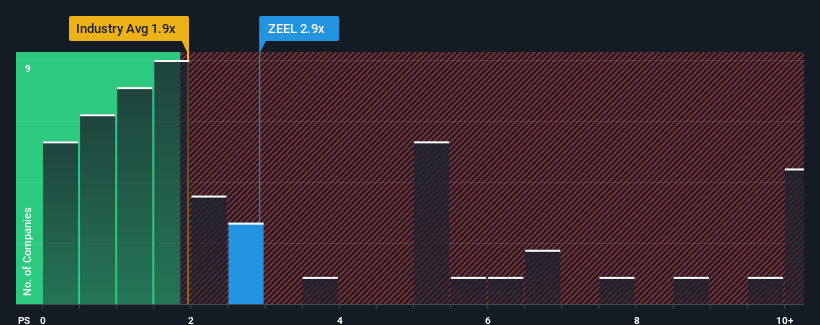

When close to half the companies in the Media industry in India have price-to-sales ratios (or "P/S") below 1.9x, you may consider Zee Entertainment Enterprises Limited (NSE:ZEEL) as a stock to potentially avoid with its 2.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Zee Entertainment Enterprises

How Zee Entertainment Enterprises Has Been Performing

Zee Entertainment Enterprises could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zee Entertainment Enterprises.How Is Zee Entertainment Enterprises' Revenue Growth Trending?

Zee Entertainment Enterprises' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.0% last year. Revenue has also lifted 23% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 5.0% per year over the next three years. With the industry predicted to deliver 12% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Zee Entertainment Enterprises' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Zee Entertainment Enterprises' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Zee Entertainment Enterprises currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 3 warning signs for Zee Entertainment Enterprises that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zee Entertainment Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ZEEL

Zee Entertainment Enterprises

Engages in broadcasting satellite television channels and digital media in India and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives