More Unpleasant Surprises Could Be In Store For Zee Entertainment Enterprises Limited's (NSE:ZEEL) Shares After Tumbling 38%

Zee Entertainment Enterprises Limited (NSE:ZEEL) shareholders that were waiting for something to happen have been dealt a blow with a 38% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 21% in that time.

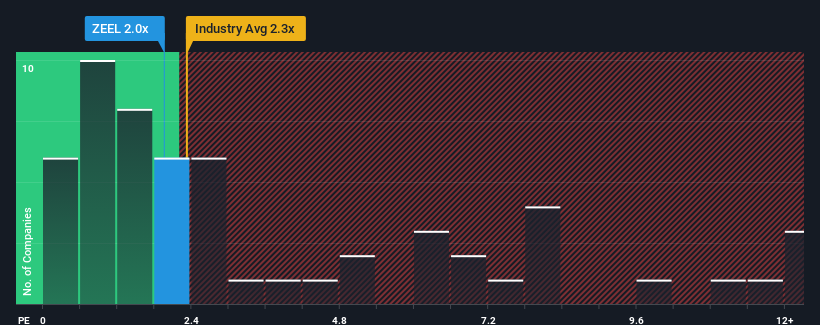

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Zee Entertainment Enterprises' P/S ratio of 2x, since the median price-to-sales (or "P/S") ratio for the Media industry in India is also close to 2.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Zee Entertainment Enterprises

How Has Zee Entertainment Enterprises Performed Recently?

Recent times haven't been great for Zee Entertainment Enterprises as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zee Entertainment Enterprises.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Zee Entertainment Enterprises' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.0% last year. The latest three year period has also seen a 23% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 7.1% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 11% per year, which is noticeably more attractive.

With this in mind, we find it intriguing that Zee Entertainment Enterprises' P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Zee Entertainment Enterprises looks to be in line with the rest of the Media industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Zee Entertainment Enterprises' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Zee Entertainment Enterprises (of which 1 is concerning!) you should know about.

If you're unsure about the strength of Zee Entertainment Enterprises' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Zee Entertainment Enterprises, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zee Entertainment Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ZEEL

Zee Entertainment Enterprises

Engages in broadcasting satellite television channels and digital media in India and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives