Shareholders May Be More Conservative With T.V. Today Network Limited's (NSE:TVTODAY) CEO Compensation For Now

Performance at T.V. Today Network Limited (NSE:TVTODAY) has been reasonably good and CEO Kalli Bhandal has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 27 September 2022. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for T.V. Today Network

Comparing T.V. Today Network Limited's CEO Compensation With The Industry

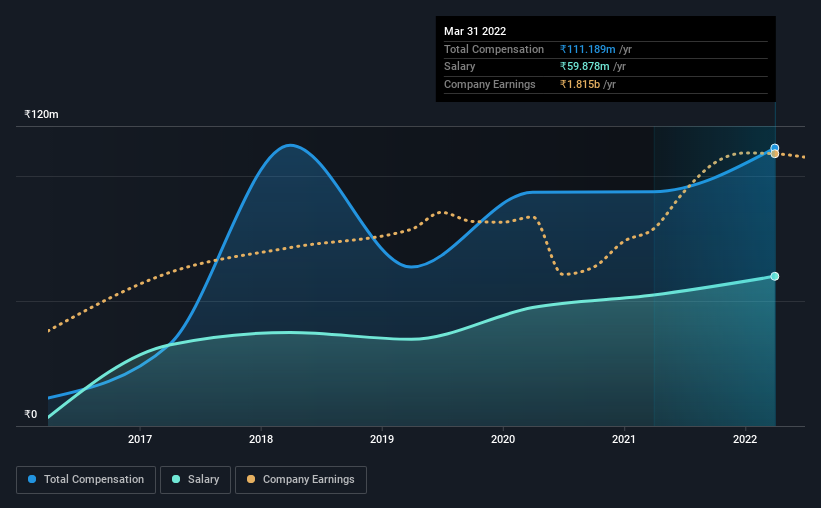

Our data indicates that T.V. Today Network Limited has a market capitalization of ₹18b, and total annual CEO compensation was reported as ₹111m for the year to March 2022. That's a notable increase of 19% on last year. In particular, the salary of ₹59.9m, makes up a fairly large portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from ₹8.0b to ₹32b, we found that the median CEO total compensation was ₹33m. Accordingly, our analysis reveals that T.V. Today Network Limited pays Kalli Bhandal north of the industry median.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹60m | ₹52m | 54% |

| Other | ₹51m | ₹41m | 46% |

| Total Compensation | ₹111m | ₹94m | 100% |

On an industry level, roughly 100% of total compensation represents salary and 0.2491% is other remuneration. T.V. Today Network pays a modest slice of remuneration through salary, as compared to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at T.V. Today Network Limited's Growth Numbers

Over the past three years, T.V. Today Network Limited has seen its earnings per share (EPS) grow by 8.0% per year. Its revenue is up 15% over the last year.

This revenue growth could really point to a brighter future. And, while modest, the EPS growth is noticeable. Although we'll stop short of calling the stock a top performer, we think the company has potential. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has T.V. Today Network Limited Been A Good Investment?

T.V. Today Network Limited has generated a total shareholder return of 4.1% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for T.V. Today Network that investors should think about before committing capital to this stock.

Important note: T.V. Today Network is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if T.V. Today Network might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TVTODAY

T.V. Today Network

Engages in the broadcasting of television news channels and other media operations in India, the United States, Ireland, the United Kingdom, Canada, the United Arab Emirates, Qatar, South Africa, Maldives, and Seychelles.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026