- India

- /

- Consumer Services

- /

- NSEI:TOUCHWOOD

Does Touchwood Entertainment (NSE:TOUCHWOOD) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Touchwood Entertainment (NSE:TOUCHWOOD). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Touchwood Entertainment with the means to add long-term value to shareholders.

View our latest analysis for Touchwood Entertainment

Touchwood Entertainment's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. We can see that in the last three years Touchwood Entertainment grew its EPS by 7.5% per year. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

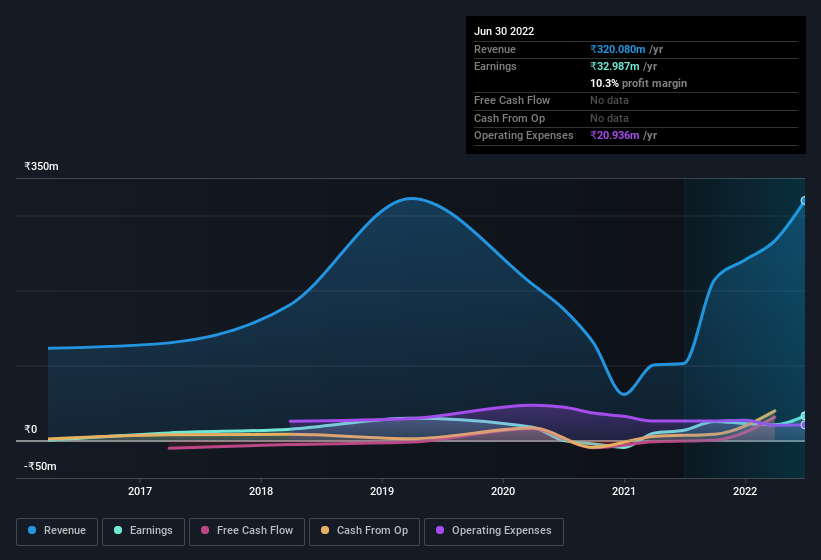

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the one hand, Touchwood Entertainment's EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Touchwood Entertainment isn't a huge company, given its market capitalisation of ₹911m. That makes it extra important to check on its balance sheet strength.

Are Touchwood Entertainment Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Touchwood Entertainment shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Executive Chairman & MD Manjit Singh bought ₹3.0m worth of shares at an average price of around ₹127. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Touchwood Entertainment will reveal that insiders own a significant piece of the pie. In fact, they own 82% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Although, with Touchwood Entertainment being valued at ₹911m, this is a small company we're talking about. So despite a large proportional holding, insiders only have ₹752m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is Touchwood Entertainment Worth Keeping An Eye On?

One important encouraging feature of Touchwood Entertainment is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. What about risks? Every company has them, and we've spotted 3 warning signs for Touchwood Entertainment you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Touchwood Entertainment, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Touchwood Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TOUCHWOOD

Touchwood Entertainment

Engages in the provision of wedding and event management services in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives