- India

- /

- Renewable Energy

- /

- NSEI:JPPOWER

Undiscovered Gems In India 3 Small Cap Stocks With Potential

Reviewed by Simply Wall St

In the last week, the Indian market has been flat, yet it has experienced a remarkable 40% increase over the past year with earnings forecasted to grow by 17% annually. In this context of robust growth, identifying small-cap stocks with strong fundamentals and growth potential can be key to uncovering promising investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| 3B Blackbio Dx | 0.38% | -0.88% | -1.47% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.22% | 8.68% | ★★★★★★ |

| TechNVision Ventures | 100.73% | 20.37% | 68.50% | ★★★★★★ |

| Voith Paper Fabrics India | 0.07% | 10.95% | 9.70% | ★★★★★☆ |

| Macpower CNC Machines | 0.40% | 22.04% | 31.09% | ★★★★★☆ |

| Master Trust | 37.05% | 27.64% | 41.99% | ★★★★★☆ |

| TCPL Packaging | 95.84% | 15.51% | 31.89% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 22.05% | 60.31% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.69% | ★★★★★☆ |

| Share India Securities | 24.23% | 37.59% | 48.98% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Ingersoll-Rand (India) (NSEI:INGERRAND)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ingersoll-Rand (India) Limited specializes in the manufacturing and sale of industrial air compressors within India, with a market capitalization of ₹139.99 billion.

Operations: The primary revenue stream for Ingersoll-Rand (India) comes from its Air Solutions segment, generating ₹12.27 billion.

Ingersoll-Rand (India), a small cap player in the machinery sector, has shown consistent earnings growth at 27.5% annually over five years, though recent growth of 12.9% lagged behind the industry's 25.9%. The company boasts high-quality earnings and maintains more cash than total debt, indicating robust financial health. Recent results highlight an increase in net income to ₹618 million from ₹537 million year-on-year, with dividends affirmed at ₹20 per share for fiscal year-end March 2024.

- Click here and access our complete health analysis report to understand the dynamics of Ingersoll-Rand (India).

Learn about Ingersoll-Rand (India)'s historical performance.

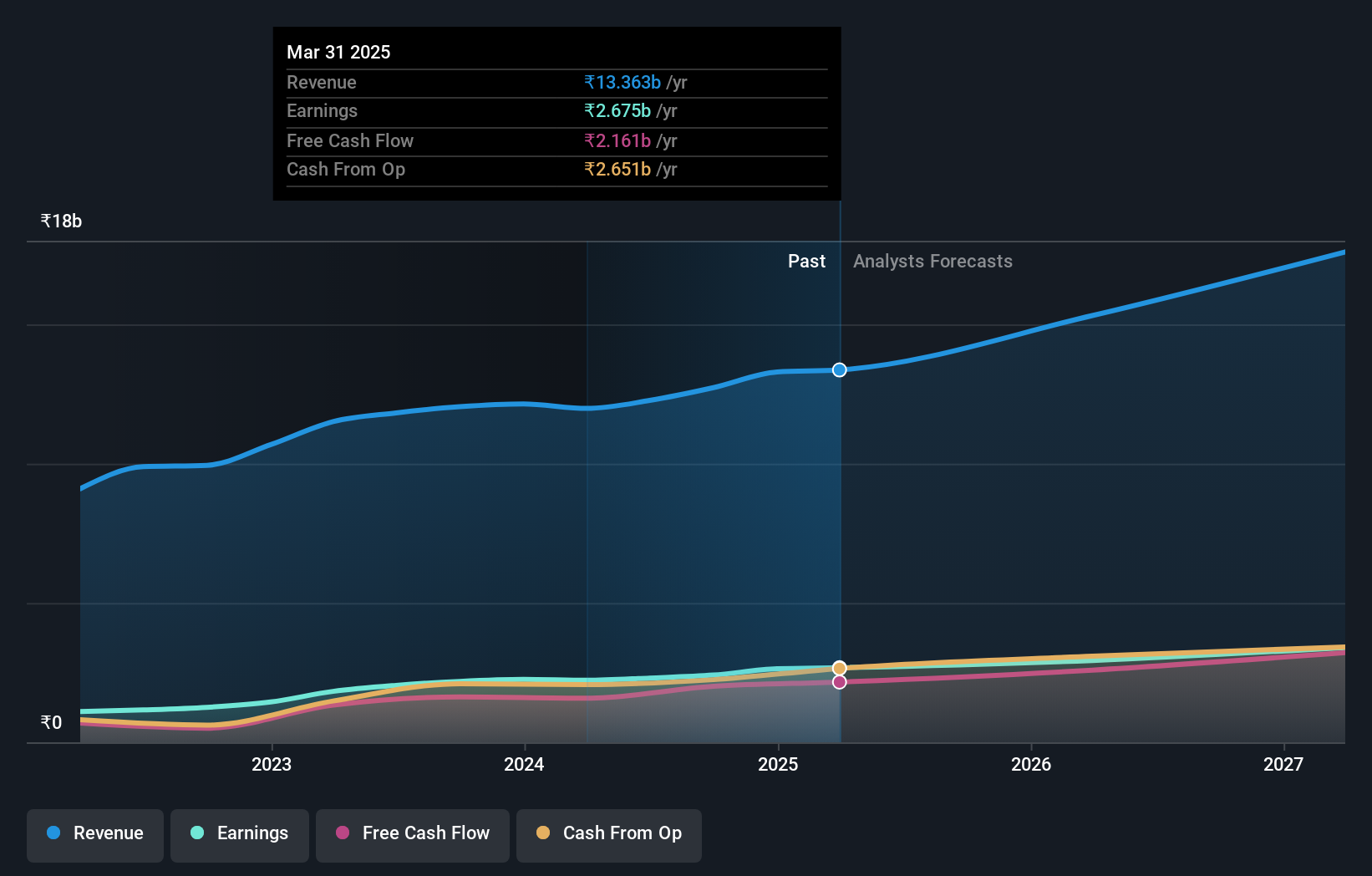

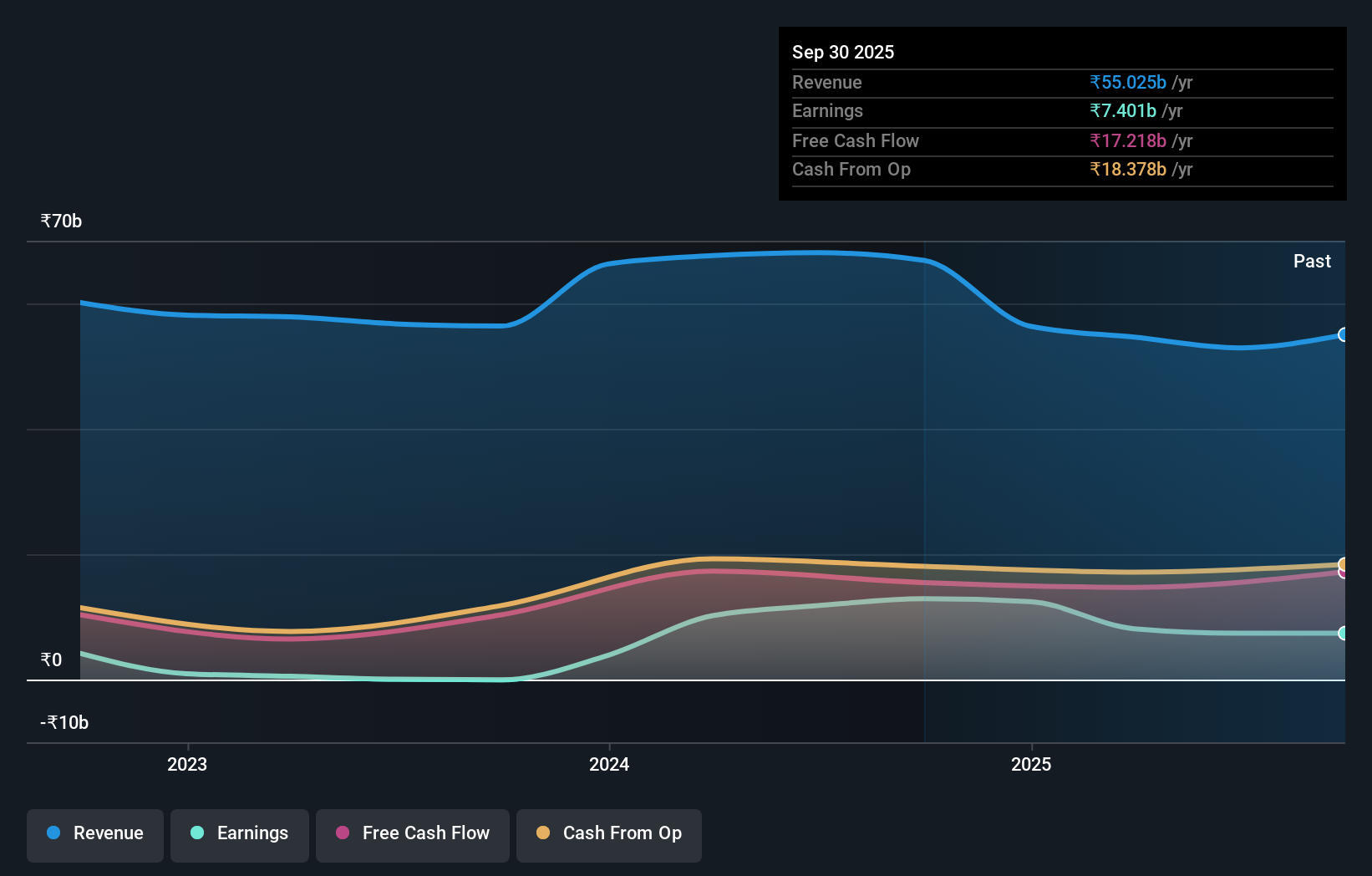

Jaiprakash Power Ventures (NSEI:JPPOWER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jaiprakash Power Ventures Limited operates in the power generation and cement grinding sectors both within India and internationally, with a market capitalization of ₹152.90 billion.

Operations: The company generates revenue primarily from power and coal, with power contributing significantly at ₹61.68 billion. Coal adds ₹6.59 billion to the revenue stream. Segment adjustments total ₹6.42 billion, impacting overall financials.

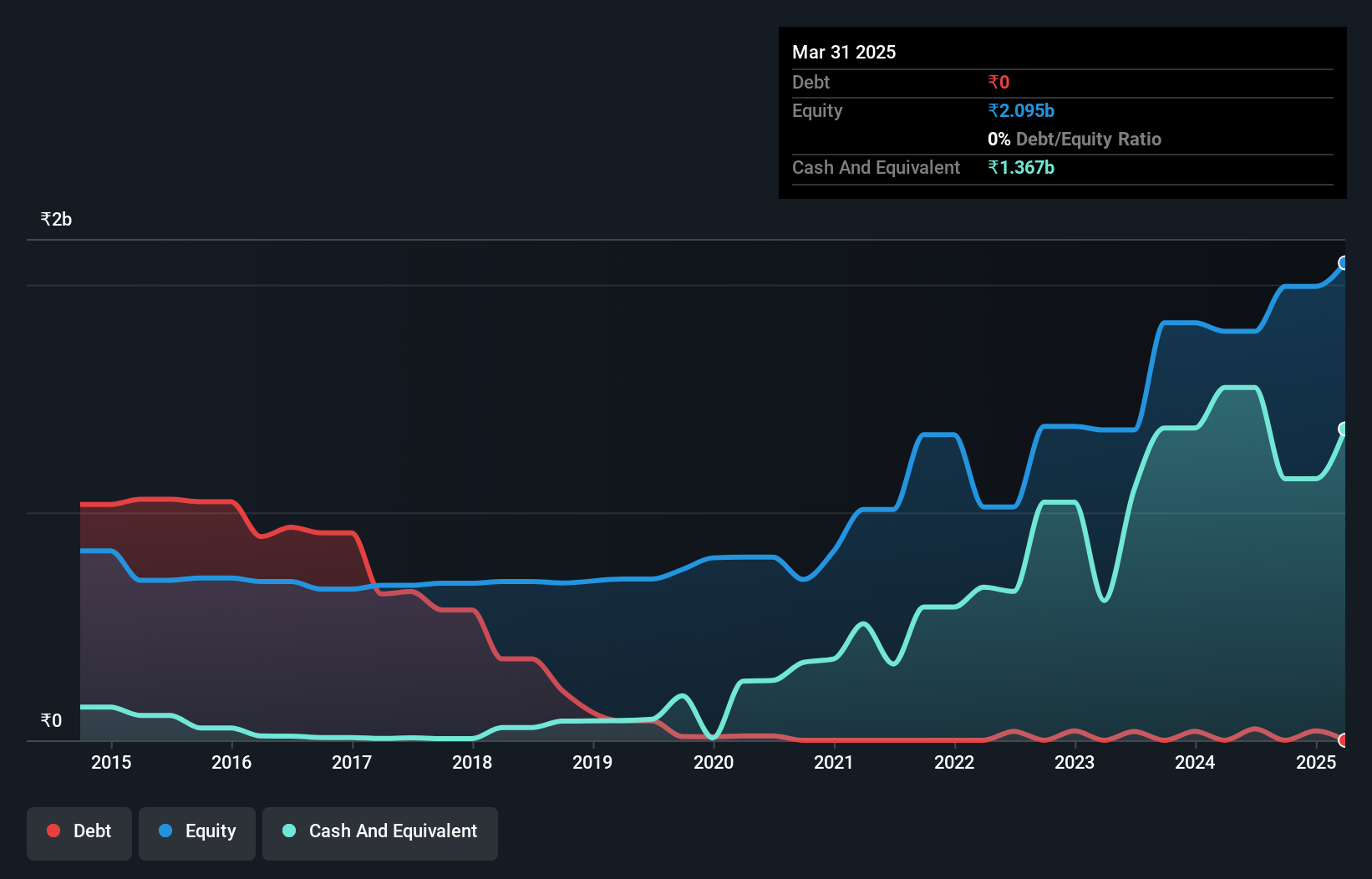

Jaiprakash Power Ventures, operating in the renewable energy sector, has shown remarkable financial improvement. Over the past year, earnings skyrocketed by 22,969%, outpacing industry growth of 12%. The company's debt-to-equity ratio impressively decreased from 254.1% to 37% over five years, indicating effective debt management. Despite a significant one-off loss of ₹6.9B impacting recent results, interest payments are well-covered at 5.2x EBIT, suggesting robust financial health and potential for future value realization.

Tips Music (NSEI:TIPSMUSIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Tips Music Limited focuses on acquiring and exploiting music rights both in India and internationally, with a market capitalization of ₹105.99 billion.

Operations: Tips Music Limited generates revenue primarily from its music segment, which includes audio and video content, amounting to ₹2.63 billion.

With a robust 66% earnings growth last year, Tips Music is making waves in the entertainment sector, outpacing industry growth of 32%. The debt-to-equity ratio improved from 12.1% to 2.8% over five years, showing financial prudence. Recent earnings report highlights a net income of ₹435 million for Q1 2024 compared to ₹271 million previously, with revenue jumping to ₹785 million from ₹546 million. High-quality earnings and positive free cash flow bolster its promising outlook.

- Click here to discover the nuances of Tips Music with our detailed analytical health report.

Explore historical data to track Tips Music's performance over time in our Past section.

Turning Ideas Into Actions

- Dive into all 469 of the Indian Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JPPOWER

Jaiprakash Power Ventures

Engages in the power generation and cement grinding businesses in India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026