- India

- /

- Entertainment

- /

- NSEI:SAREGAMA

Is Now The Time To Put Saregama India (NSE:SAREGAMA) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Saregama India (NSE:SAREGAMA). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Saregama India

How Fast Is Saregama India Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Who among us would not applaud Saregama India's stratospheric annual EPS growth of 59%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Unfortunately, Saregama India's revenue dropped 15% last year, but the silver lining is that EBIT margins improved from 11% to 28%. That falls short of ideal.

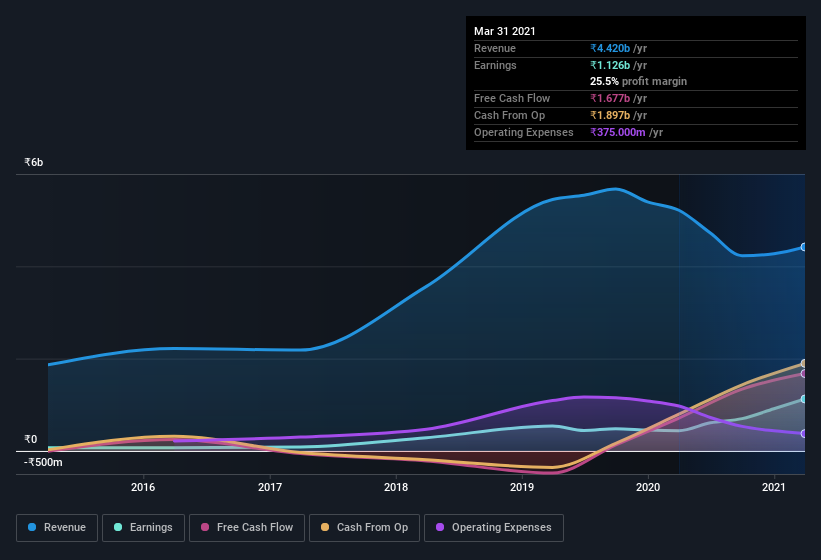

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Saregama India Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The first bit of good news is that no Saregama India insiders reported share sales in the last twelve months. Even better, though, is that the MD & Executive Director, Vikram Mehra, bought a whopping ₹34m worth of shares, paying about ₹171 per share, on average. Big buys like that give me a sense of opportunity; actions speak louder than words.

The good news, alongside the insider buying, for Saregama India bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have ₹1.7b worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 3.9% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Saregama India Worth Keeping An Eye On?

Saregama India's earnings have taken off like any random crypto-currency did, back in 2017. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Saregama India deserves timely attention. What about risks? Every company has them, and we've spotted 2 warning signs for Saregama India you should know about.

The good news is that Saregama India is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Saregama India, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SAREGAMA

Saregama India

Operates as an entertainment company in India and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives