Some Investors May Be Worried About Sambhaav Media's (NSE:SAMBHAAV) Returns On Capital

When we're researching a company, it's sometimes hard to find the warning signs, but there are some financial metrics that can help spot trouble early. Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. Basically the company is earning less on its investments and it is also reducing its total assets. And from a first read, things don't look too good at Sambhaav Media (NSE:SAMBHAAV), so let's see why.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Sambhaav Media is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.029 = ₹27m ÷ (₹991m - ₹66m) (Based on the trailing twelve months to September 2024).

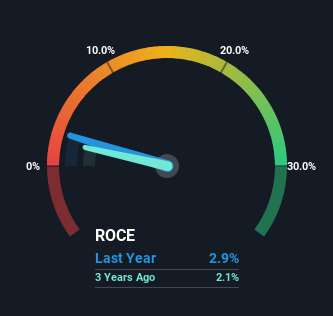

Therefore, Sambhaav Media has an ROCE of 2.9%. Ultimately, that's a low return and it under-performs the Media industry average of 8.5%.

See our latest analysis for Sambhaav Media

Historical performance is a great place to start when researching a stock so above you can see the gauge for Sambhaav Media's ROCE against it's prior returns. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Sambhaav Media.

So How Is Sambhaav Media's ROCE Trending?

We are a bit worried about the trend of returns on capital at Sambhaav Media. About five years ago, returns on capital were 4.9%, however they're now substantially lower than that as we saw above. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. Companies that exhibit these attributes tend to not be shrinking, but they can be mature and facing pressure on their margins from competition. If these trends continue, we wouldn't expect Sambhaav Media to turn into a multi-bagger.

The Bottom Line

In the end, the trend of lower returns on the same amount of capital isn't typically an indication that we're looking at a growth stock. The market must be rosy on the stock's future because even though the underlying trends aren't too encouraging, the stock has soared 196%. In any case, the current underlying trends don't bode well for long term performance so unless they reverse, we'd start looking elsewhere.

Sambhaav Media does come with some risks though, we found 2 warning signs in our investment analysis, and 1 of those is concerning...

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SAMBHAAV

Sambhaav Media

Sambhaav Media Limited publishes newspapers and magazines, and engages in the radio broadcasting and audio video media businesses in India.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026