Raj Television Network Limited's (NSE:RAJTV) Stock Retreats 28% But Revenues Haven't Escaped The Attention Of Investors

Raj Television Network Limited (NSE:RAJTV) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 18% share price drop.

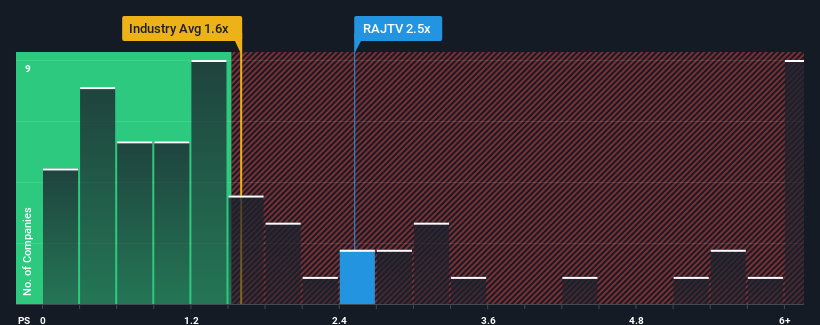

Although its price has dipped substantially, you could still be forgiven for thinking Raj Television Network is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.5x, considering almost half the companies in India's Media industry have P/S ratios below 1.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Raj Television Network

How Raj Television Network Has Been Performing

For instance, Raj Television Network's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Raj Television Network will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Raj Television Network's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.7%. Even so, admirably revenue has lifted 49% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 12% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in consideration, it's not hard to understand why Raj Television Network's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does Raj Television Network's P/S Mean For Investors?

Despite the recent share price weakness, Raj Television Network's P/S remains higher than most other companies in the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Raj Television Network revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

It is also worth noting that we have found 2 warning signs for Raj Television Network (1 doesn't sit too well with us!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RAJTV

Raj Television Network

Operates as a television satellite broadcaster in India.

Mediocre balance sheet very low.

Similar Companies

Market Insights

Community Narratives