The five-year loss for Music Broadcast (NSE:RADIOCITY) shareholders likely driven by its shrinking earnings

While not a mind-blowing move, it is good to see that the Music Broadcast Limited (NSE:RADIOCITY) share price has gained 16% in the last three months. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Indeed, the share price is down a whopping 75% in that time. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The fundamental business performance will ultimately determine if the turnaround can be sustained.

While the last five years has been tough for Music Broadcast shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Music Broadcast

While Music Broadcast made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over half a decade Music Broadcast reduced its trailing twelve month revenue by 15% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not that strange that the share price dropped 12% per year in that period. We don't think this is a particularly promising picture. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

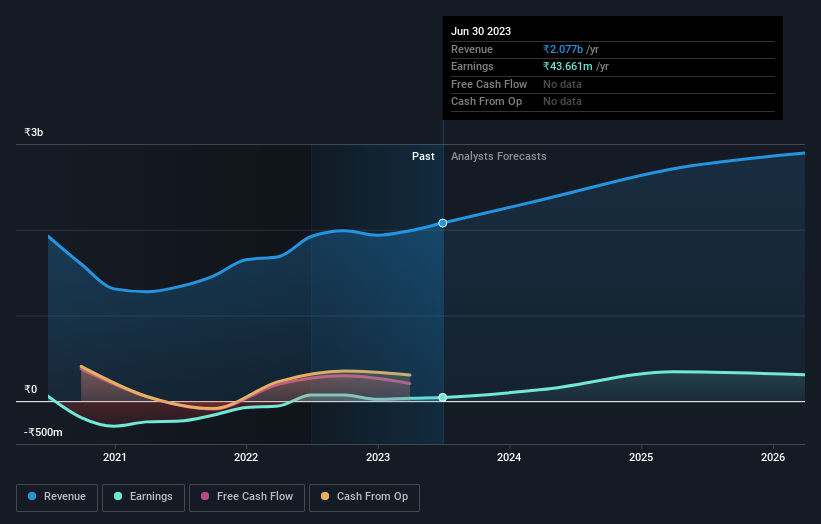

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Music Broadcast's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Music Broadcast had a tough year, with a total loss of 48%, against a market gain of about 9.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Music Broadcast better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Music Broadcast you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RADIOCITY

Music Broadcast

Engages in the operating of FM radio stations under the Radio City brand name in India.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives