- India

- /

- Entertainment

- /

- NSEI:PVRINOX

Take Care Before Diving Into The Deep End On PVR INOX Limited (NSE:PVRINOX)

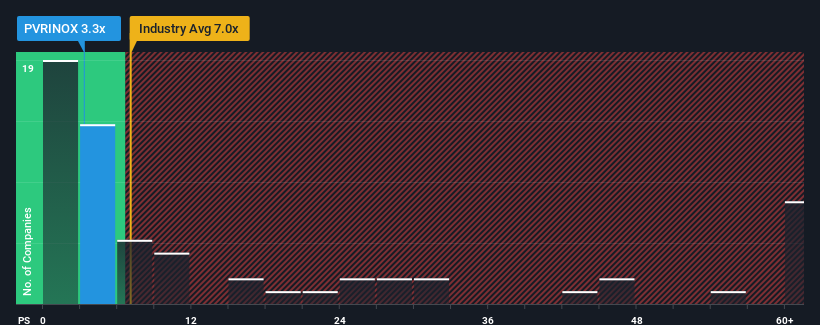

With a price-to-sales (or "P/S") ratio of 3.3x PVR INOX Limited (NSE:PVRINOX) may be sending very bullish signals at the moment, given that almost half of all the Entertainment companies in India have P/S ratios greater than 7x and even P/S higher than 29x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for PVR INOX

What Does PVR INOX's P/S Mean For Shareholders?

PVR INOX's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PVR INOX.How Is PVR INOX's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as PVR INOX's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 91% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 234% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 18% per annum over the next three years. With the industry only predicted to deliver 5.9% each year, the company is positioned for a stronger revenue result.

With this information, we find it odd that PVR INOX is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at PVR INOX's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for PVR INOX that you should be aware of.

If these risks are making you reconsider your opinion on PVR INOX, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PVRINOX

PVR INOX

A theatrical exhibition company, engages in the exhibition, distribution, and production of movies in India and Sri Lanka.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026