Investors Give Network18 Media & Investments Limited (NSE:NETWORK18) Shares A 27% Hiding

Network18 Media & Investments Limited (NSE:NETWORK18) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 48%, which is great even in a bull market.

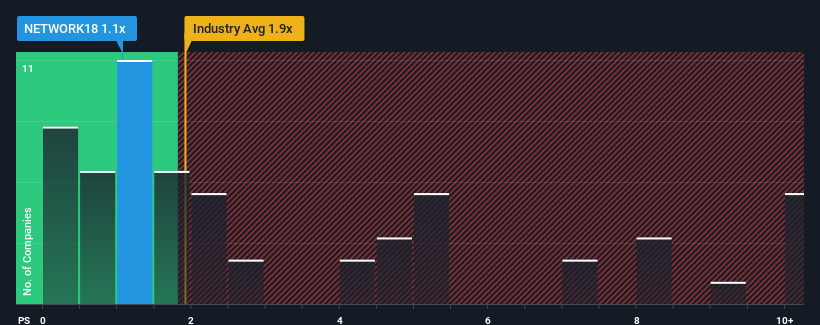

Since its price has dipped substantially, Network18 Media & Investments' price-to-sales (or "P/S") ratio of 1.1x might make it look like a buy right now compared to the Media industry in India, where around half of the companies have P/S ratios above 1.9x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Network18 Media & Investments

What Does Network18 Media & Investments' P/S Mean For Shareholders?

Network18 Media & Investments certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Network18 Media & Investments will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Network18 Media & Investments' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 31% gain to the company's top line. The latest three year period has also seen an excellent 76% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 13% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Network18 Media & Investments' P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Network18 Media & Investments' P/S Mean For Investors?

Network18 Media & Investments' recently weak share price has pulled its P/S back below other Media companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Network18 Media & Investments revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Network18 Media & Investments that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Network18 Media & Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NETWORK18

Network18 Media & Investments

Engages in broadcasting, digital content, print, and allied businesses in India.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives