- India

- /

- Interactive Media and Services

- /

- NSEI:NAUKRI

What You Can Learn From Info Edge (India) Limited's (NSE:NAUKRI) P/S

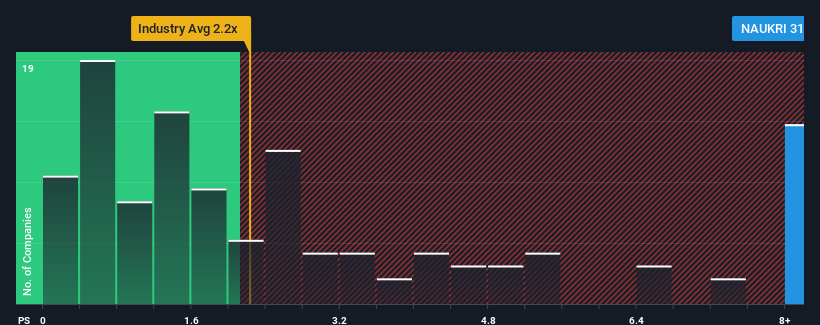

When close to half the companies in the Interactive Media and Services industry in India have price-to-sales ratios (or "P/S") below 2.2x, you may consider Info Edge (India) Limited (NSE:NAUKRI) as a stock to avoid entirely with its 31.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Info Edge (India)

What Does Info Edge (India)'s Recent Performance Look Like?

There hasn't been much to differentiate Info Edge (India)'s and the industry's revenue growth lately. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Info Edge (India)'s future stacks up against the industry? In that case, our free report is a great place to start.How Is Info Edge (India)'s Revenue Growth Trending?

Info Edge (India)'s P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 116% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 13% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 10% per year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Info Edge (India)'s P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Info Edge (India)'s P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Info Edge (India) shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 4 warning signs for Info Edge (India) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NAUKRI

Info Edge (India)

Operates as an online classifieds company in the areas of recruitment, matrimony, real estate, and education and related services in India and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives