- India

- /

- Interactive Media and Services

- /

- NSEI:NAUKRI

What Info Edge (India) Limited's (NSE:NAUKRI) P/S Is Not Telling You

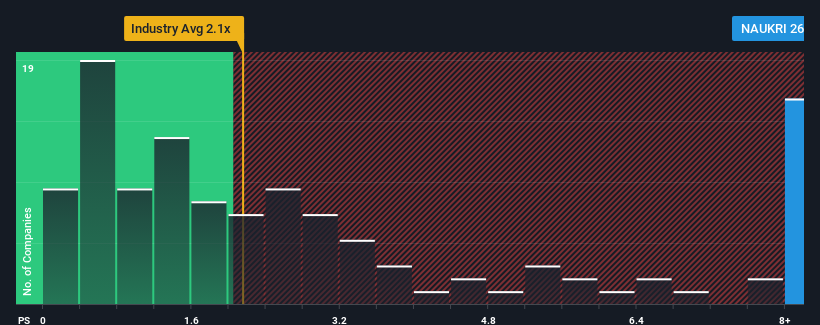

When close to half the companies in the Interactive Media and Services industry in India have price-to-sales ratios (or "P/S") below 2.1x, you may consider Info Edge (India) Limited (NSE:NAUKRI) as a stock to avoid entirely with its 26.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Info Edge (India)

What Does Info Edge (India)'s Recent Performance Look Like?

Info Edge (India) certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Info Edge (India) will help you uncover what's on the horizon.How Is Info Edge (India)'s Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Info Edge (India)'s is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. The latest three year period has also seen an excellent 102% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 12% per year during the coming three years according to the analysts following the company. With the industry predicted to deliver 11% growth per year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Info Edge (India)'s P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Analysts are forecasting Info Edge (India)'s revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Info Edge (India) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NAUKRI

Info Edge (India)

Operates as an online classifieds company in the areas of recruitment, matrimony, real estate, and education and related services in India and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.