Bank of Baroda And Two Other Leading Dividend Stocks On The Indian Exchange

Reviewed by Simply Wall St

Over the past year, the Indian stock market has shown robust growth with a 45% increase, although it has remained flat in the last week. In this dynamic environment, dividend stocks like Bank of Baroda stand out as attractive options for investors looking to benefit from consistent income combined with potential capital appreciation, especially given the expected annual earnings growth of 16%.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Balmer Lawrie Investments (BSE:532485) | 3.94% | ★★★★★★ |

| Gulf Oil Lubricants India (NSEI:GULFOILLUB) | 3.30% | ★★★★★☆ |

| D. B (NSEI:DBCORP) | 3.37% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.33% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.38% | ★★★★★☆ |

| Bharat Petroleum (NSEI:BPCL) | 6.90% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.64% | ★★★★★☆ |

| Oil and Natural Gas (NSEI:ONGC) | 3.99% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.03% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.42% | ★★★★★☆ |

Click here to see the full list of 15 stocks from our Top Indian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

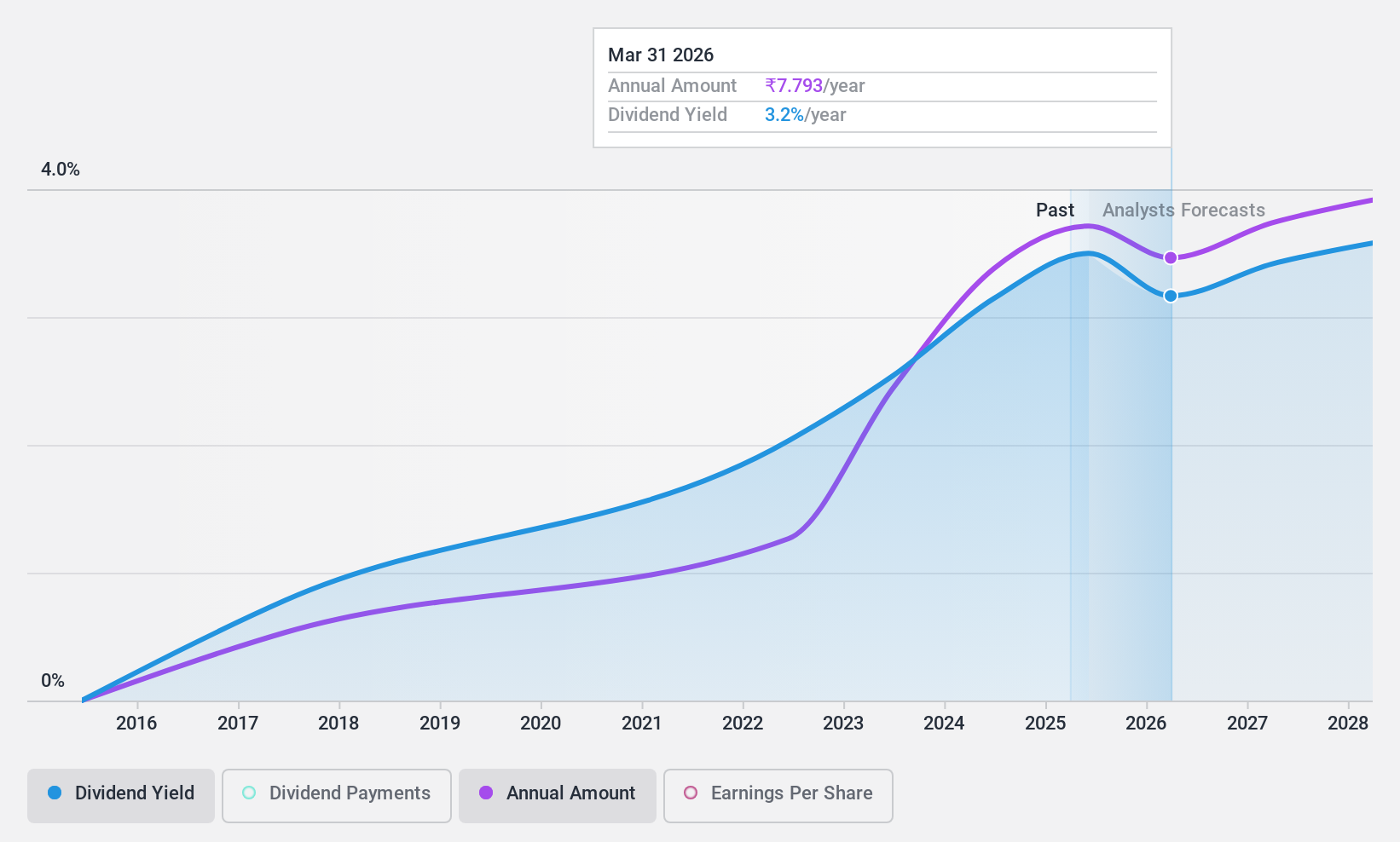

Bank of Baroda (NSEI:BANKBARODA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Baroda Limited is a global banking institution offering a wide range of services to individual, government, and corporate clients, with a market capitalization of approximately ₹1.30 trillion.

Operations: Bank of Baroda Limited generates revenue primarily through Treasury (₹322.05 billion), Corporate/Wholesale Banking (₹495.75 billion), and Retail Banking, which includes Digital Banking (₹0.01 billion) and Other Retail Banking (₹490.88 billion).

Dividend Yield: 3%

Bank of Baroda's recent dividend announcement of INR 7.60 per share, coupled with a solid earnings report for FY 2024, underscores its potential as a dividend stock. However, the bank's history of volatile dividends and a high level of bad loans (2.9%) pose risks. The recent executive changes and regulatory scrutiny, including a significant tax demand which the bank is contesting, add elements of uncertainty to its operational stability. Despite these challenges, the dividends are currently well-covered by earnings (20.9% payout ratio), suggesting some resilience in its financials amidst ongoing issues.

- Click here and access our complete dividend analysis report to understand the dynamics of Bank of Baroda.

- The valuation report we've compiled suggests that Bank of Baroda's current price could be quite moderate.

D. B (NSEI:DBCORP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and provides digital news platforms and event management services globally, with a market cap of approximately ₹68.68 billion.

Operations: D. B. Corp Limited generates revenue primarily through its printing and publishing business, which contributes ₹22.43 billion, and its radio segment, which adds another ₹1.59 billion.

Dividend Yield: 3.4%

D. B. Corp Limited's recent dividend increase to INR 8 per share reflects a positive step, though its history of fluctuating dividends raises caution. The company reported significant growth in net income to INR 4,255.23 million and an earnings surge by 151.7% over the past year, supporting the sustainability of its dividends with a payout ratio of 54.4% and cash payout ratio at 43.6%. However, the appointment of a new President Finance amidst these changes could introduce variables affecting future dividend reliability.

- Click here to discover the nuances of D. B with our detailed analytical dividend report.

- Our expertly prepared valuation report D. B implies its share price may be too high.

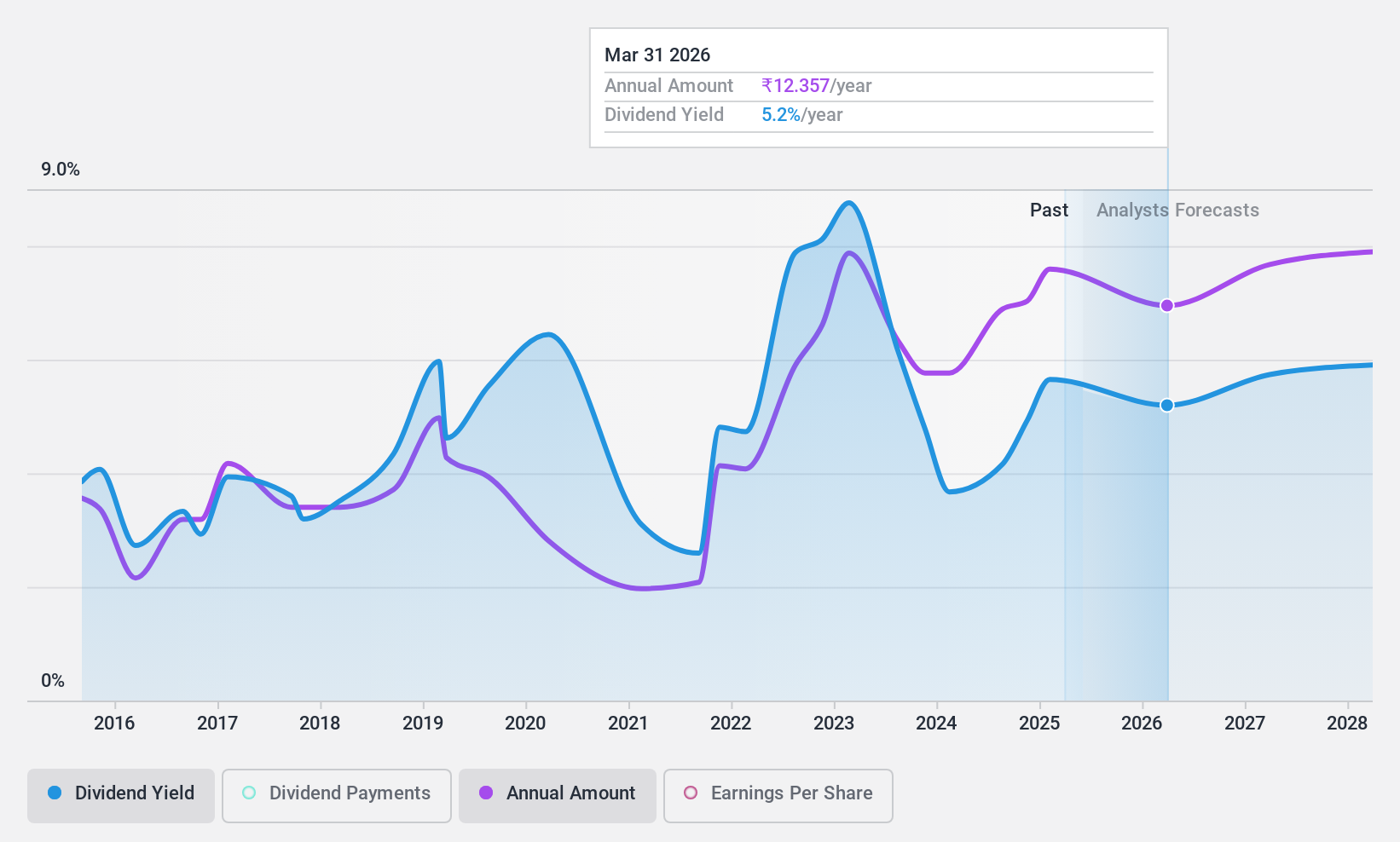

Oil and Natural Gas (NSEI:ONGC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oil and Natural Gas Corporation Limited, operating both domestically and internationally, is engaged in the exploration, development, and production of crude oil and natural gas with a market capitalization of approximately ₹3.86 trillion.

Operations: Oil and Natural Gas Corporation Limited generates revenue primarily through refining and marketing (₹56.75 billion), offshore exploration and production (₹9.43 billion), onshore exploration and production (₹4.39 billion), and international operations (₹0.96 billion).

Dividend Yield: 4%

Oil and Natural Gas Corporation Limited (ONGC) has shown a mixed performance in dividend reliability, with some volatility over the past decade. However, recent financials indicate a positive trend, with earnings growing by 38.9% over the last year. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 31.3% and 32.5%, respectively. Despite this coverage, the historical instability in dividend payments suggests cautious optimism for future consistency. The recent appointment of Shri Vivek Chandrakant Tongaonkar as CFO could influence financial strategies moving forward.

- Get an in-depth perspective on Oil and Natural Gas' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Oil and Natural Gas is priced lower than what may be justified by its financials.

Make It Happen

- Click here to access our complete index of 15 Top Indian Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Baroda might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BANKBARODA

Bank of Baroda

Provides various banking products and services to individuals, government departments, and corporate customers in India and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026