Does Cyber Media (India) (NSE:CYBERMEDIA) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Cyber Media (India) (NSE:CYBERMEDIA). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Cyber Media (India) with the means to add long-term value to shareholders.

See our latest analysis for Cyber Media (India)

Cyber Media (India)'s Improving Profits

In the last three years Cyber Media (India)'s earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, Cyber Media (India)'s EPS grew from ₹1.31 to ₹3.22, over the previous 12 months. It's not often a company can achieve year-on-year growth of 145%.

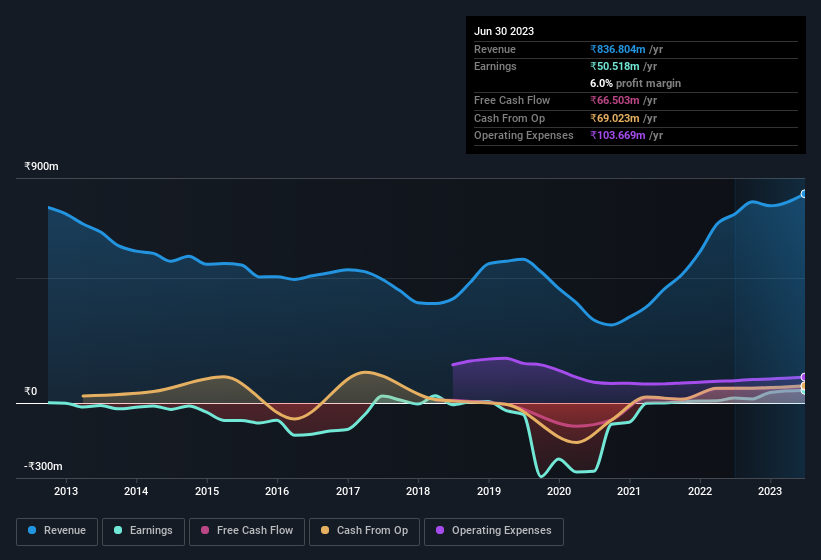

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Cyber Media (India) maintained stable EBIT margins over the last year, all while growing revenue 11% to ₹837m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Cyber Media (India) is no giant, with a market capitalisation of ₹291m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Cyber Media (India) Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that Cyber Media (India) insiders own a significant number of shares certainly is appealing. In fact, they own 83% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Valued at only ₹291m Cyber Media (India) is really small for a listed company. So despite a large proportional holding, insiders only have ₹241m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Does Cyber Media (India) Deserve A Spot On Your Watchlist?

Cyber Media (India)'s earnings per share have been soaring, with growth rates sky high. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching Cyber Media (India) very closely. It's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Cyber Media (India) (at least 1 which is significant) , and understanding them should be part of your investment process.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CYBERMEDIA

Cyber Media (India)

Engages in the media business in India and internationally.

Medium-low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026