We Ran A Stock Scan For Earnings Growth And Affle (India) (NSE:AFFLE) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Affle (India) (NSE:AFFLE), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Affle (India)

How Fast Is Affle (India) Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Affle (India)'s shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 59%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

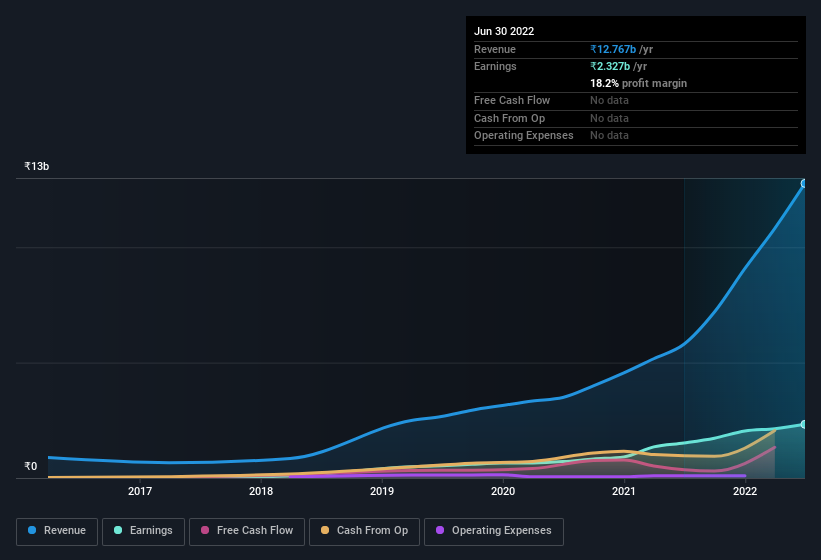

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While Affle (India) did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Affle (India)'s forecast profits?

Are Affle (India) Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see Affle (India) insiders walking the walk, by spending ₹30m on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. Zooming in, we can see that the biggest insider purchase was by Chief Financial & Operations Officer Kapil Bhutani for ₹28m worth of shares, at about ₹1,194 per share.

It's commendable to see that insiders have been buying shares in Affle (India), but there is more evidence of shareholder friendly management. To be specific, the CEO is paid modestly when compared to company peers of the same size. Our analysis has discovered that the median total compensation for the CEOs of companies like Affle (India) with market caps between ₹80b and ₹256b is about ₹45m.

The CEO of Affle (India) was paid just ₹250k in total compensation for the year ending March 2021. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Affle (India) Worth Keeping An Eye On?

Affle (India)'s earnings have taken off in quite an impressive fashion. Not to mention the company's insiders have been adding to their portfolios and the CEO's remuneration policy looks to have had shareholders in mind seeing as it's quite modest for the company size. It could be that Affle (India) is at an inflection point, given the EPS growth. If so, then its potential for further gains probably merit a spot on your watchlist. Still, you should learn about the 1 warning sign we've spotted with Affle (India).

Keen growth investors love to see insider buying. Thankfully, Affle (India) isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AFFLE

Affle 3i

Provides mobile advertisement services through information technology and software development services for mobiles in India and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026